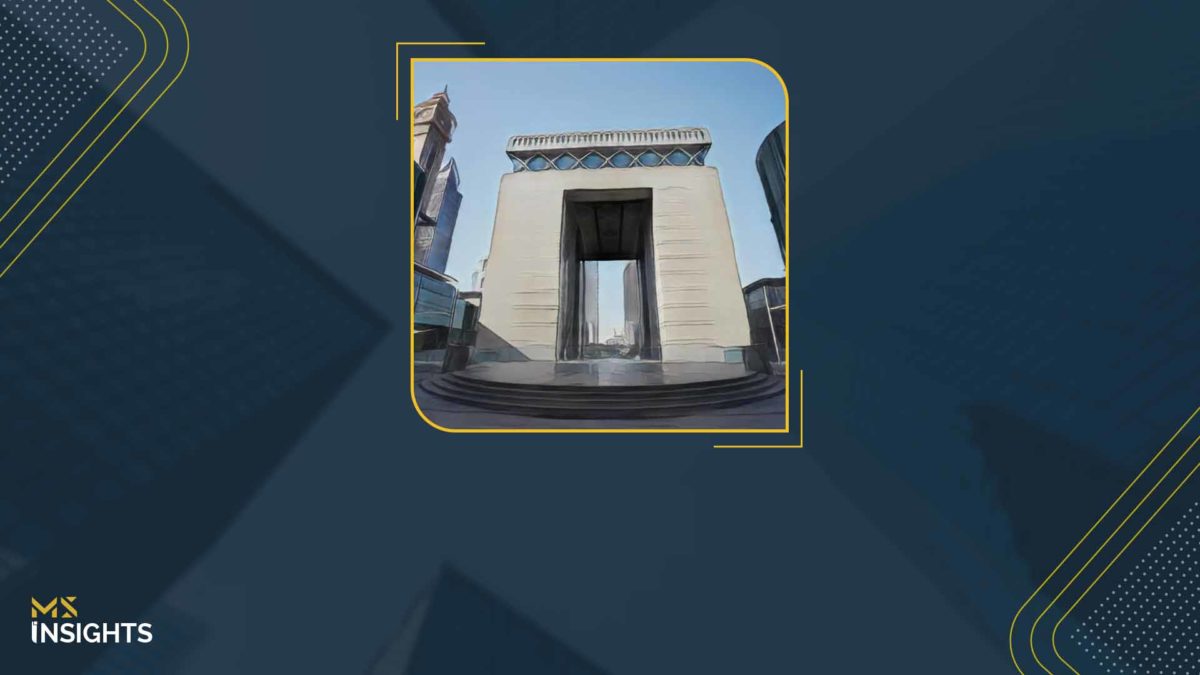

Dubai International Financial Centre (DIFC) has emerged as a global financial hub, attracting investors, families, and businesses seeking robust legal structures and a transparent regulatory framework. Among the innovative structures it offers, the DIFC Foundation stands out as a modern and flexible tool for wealth management, succession planning, and philanthropic initiatives. Setting up a foundation in DIFC combines legal certainty, governance flexibility, and asset protection, making them highly appealing to ultra-high-net-worth individuals (UHNWIs), entrepreneurs, and institutions.

What is a DIFC Foundation?

A DIFC Foundation is a legal entity with its own separate legal personality, distinct from its founders or beneficiaries. Unlike trusts, which are governed by common law, or companies, which focus on commercial operations, setting up a foundation in DIFC is primarily designed to hold and manage assets for a defined purpose. This could range from preserving family wealth and managing succession to supporting charitable activities or holding strategic business interests. The separation of assets ensures that the foundation’s property is protected from claims against individual founders, offering a high degree of financial security and continuity.

Key Features and Benefits of Setting up a Foundation in DIFC

- Separate Legal Personality: The foundation exists independently from its founders and beneficiaries. This legal separation ensures asset protection, shields the founder’s personal assets, and guarantees the foundation’s continuity even if circumstances change.

- Flexible Governance Structure: DIFC Foundations allow founders to establish tailored governance arrangements. They can appoint councils or boards to oversee the foundation’s operations, define decision-making powers, and specify roles for beneficiaries. This flexibility ensures that the foundation can adapt to the family or organization’s evolving needs.

- Purpose-Driven Asset Management: Foundations can be established for specific purposes, such as family wealth preservation, succession planning, philanthropic initiatives, or investment management. This purpose-driven approach ensures that the foundation operates efficiently while meeting the founder’s long-term objectives.

- Confidentiality and Privacy: DIFC Foundations offer high levels of confidentiality. While they are regulated under DIFC laws, they provide privacy regarding ownership and governance structures, which is particularly attractive to families and individuals seeking discretion in their wealth management strategies.

- Compliance with International Standards: DIFC Foundations operate under a regulatory framework aligned with international best practices. This compliance ensures that foundations maintain credibility, transparency, and recognition in cross-border transactions.

Applications of Setting up a Foundation in DIFC

Wealth and Succession Planning: DIFC Foundations enable families to structure and preserve their wealth for future generations. By establishing clear governance rules and asset management strategies, founders can ensure continuity and reduce potential disputes among heirs.

Philanthropy: Foundations can also serve charitable objectives, allowing founders to contribute to social causes, cultural initiatives, or educational programs while maintaining control over the use and distribution of assets.

Business Asset Holding: Setting up a foundation in DIFC can hold shares or stakes in businesses, manage investment portfolios, or act as holding vehicles for strategic assets. This provides a structured and secure approach to managing and transferring business interests.

Why Choose DIFC for a Foundation?

DIFC offers a world-class regulatory environment, recognized globally for its legal certainty, transparency, and investor-friendly policies. The DIFC Foundation framework complements these advantages, offering a unique vehicle that combines flexibility, security, and operational efficiency. For families, investors, and institutions looking to safeguard their wealth, structure succession, or pursue philanthropic goals, DIFC Foundations provide an innovative and effective solution.

How MS Can Help You with Setting up a Foundation in DIFC?

At MS, we provide advisory and support for establishing and managing DIFC Foundations. Our team of legal, corporate, and compliance experts guides clients through every step – from structuring the foundation to defining governance, drafting the constitution, and ensuring regulatory compliance. We tailor solutions to align with your wealth management, succession, and philanthropic objectives, offering clarity, efficiency, and confidentiality throughout the process. With MS as your trusted partner, setting up a foundation in DIFC becomes seamless, secure, and strategically aligned with your long-term legacy goals.