The Essentials

DIFC’s Prescribed Company Regulations 2024 are transforming Special Purpose Vehicles (SPVs) into flexible, fully compliant structures for holding assets, structured finance, IP, and family wealth planning. With clear governance, CSP-appointed directors, and passive or commercial use options, SPVs offer regulatory certainty and strategic advantages. In 2026, investors, corporates, and family offices can leverage SPVs for innovative purposes while ensuring compliance, substance, and operational efficiency in the UAE’s growing financial ecosystem.

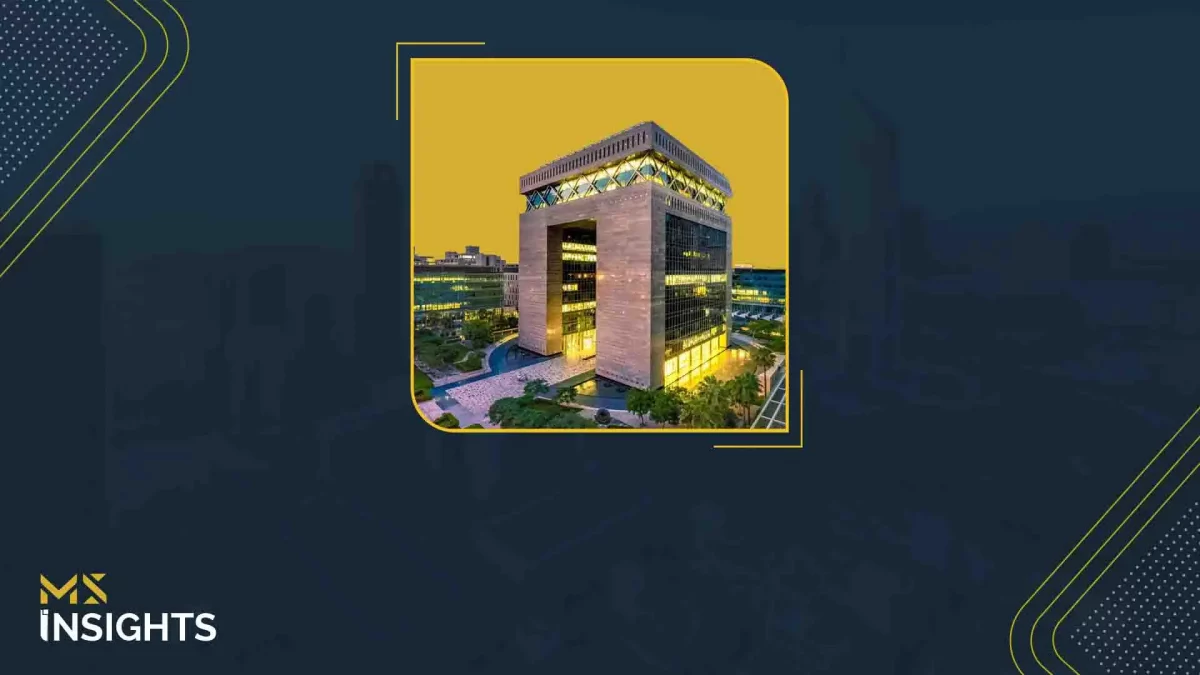

As the Gulf region cements its position as a global financial hub, Special Purpose Vehicles (SPVs) in the Dubai International Financial Centre (DIFC) are evolving beyond traditional holding structures. With the Prescribed Company Regulations 2024 introducing greater flexibility, expanded eligibility, and streamlined compliance, DIFC SPVs are becoming a powerful tool for investors, family offices, and corporates alike. From real estate and structured finance to tokenized assets and ESG projects, 2026 promises innovative uses and emerging trends that will redefine the role of SPVs in the region’s financial ecosystem.

Understanding the Reinforced SPV Regime in DIFC

What is an SPV / Prescribed Company in DIFC?

In DIFC, a Special Purpose Vehicle (SPV) is typically established as a Prescribed Company – legal entity governed by a special regime under the DIFC Companies Law designed to minimize regulatory burdens and to ring-fence risk. According to DIFC, these vehicles are meant to passively hold assets or liabilities, isolating them from other operational risk.

SPVs in DIFC benefit from several advantages: a transparent and common-law jurisdiction, cost-efficient incorporation, streamlined compliance, and a supportive legal framework for cross-border structuring.

Key Changes Under SPV Regime in DIFC

On 15 July 2024, DIFC enacted significant amendments via the Prescribed Company Regulations 2024, replacing prior versions (2019, 2020, 2022). These changes profoundly expand the SPV regime, making SPVs more accessible and flexible. Below are the most important reforms:

Broadened Eligibility

Under the new regulations, the “Qualifying Applicant” criteria have been widened. Previously, SPVs were largely limited to entities with existing ties to DIFC or low-risk applicants. This updated regime now allows any natural or corporate person globally to establish a SPV, provided they appoint a director who is an employee of a DFSA‑registered Corporate Service Provider (CSP).

The regulations now allow entities controlled by GCC persons, DIFC registered persons, or authorized firms to set up a SPV in DIFC.

Asset Holding Purpose Expanded

A DIFC SPV may now be established for the primary purpose of holding legal title to or controlling “GCC Registrable Assets”. These include assets like real estate, shares in companies, aircraft, maritime vessels, etc.

Importantly, this gives SPVs a clear “GCC nexus” in terms of asset origin, which aligns with many structuring use-cases.

Refined Qualifying Purposes

The list of “Qualifying Purposes” (i.e., allowed structuring purposes) is now more focused: the updated SPV regime defines them as (i) aviation, (ii) crowdfunding, (iii) intellectual property, (iv) maritime, and (v) structured financing.

Operational Restrictions

To preserve the passive nature of SPVs, a SPV in DIFC cannot hire employees and may only engage in holding activity or its defined “Qualifying Purpose.”

Director and Compliance Requirements

As mentioned, one key requirement is appointing a director from a DFSA-registered CSP. That CSP must also carry out certain compliance and AML (anti‑money laundering) functions on behalf of the SPV.

Commercial Package Option

For existing SPVs that no longer meet the new qualifying criteria, DIFC offers a Commercial Package – Active Enterprises. This allows more flexibility (e.g., having employees), but comes with its own licensing terms.

Transitional Arrangements

- The regulations provide a grace period (e.g., six months) for newly established or continued SPVs to meet certain requirements.

- Collectively, these reforms significantly de-risk SPV structuring, expand the use-cases, and make DIFC a more competitive jurisdiction for structuring.

DIFC’s Strategic Rationale

Why did DIFC introduce such sweeping reforms? Several driving forces are visible:

- Market Demand: There was increasing demand from both local and global sponsors for more flexible “holding company / SPV”-style vehicles. DIFC

- Substance Considerations: With the introduction of UAE Corporate Tax, substances have become more important. The SPV regime in DIFC is designed to ensure that SPVs have sufficient nexus or controls while avoiding merely paper-box structures.

- Global Structuring Competitiveness: By broadening eligibility and reducing regulatory friction, DIFC strengthens its attractiveness versus other global SPV hubs.

- Legal Certainty: The common-law environment of DIFC, combined with a trusted judicial infrastructure, provides certainty for investors in cross-border and structured-finance deals.

The Core Use Cases for DIFC SPVs: The Status Quo

Although the regime has changed, many “traditional” SPV applications remain as relevant as ever and form the bedrock for future innovation. Below are some of the most important existing use cases.

Real Estate Holding and Development Structures

In the real estate sector, SPVs remain a fundamental vehicle for structuring:

- Asset isolation: Real estate developers or sponsors use SPVs to isolate each property or development phase. This protects each asset from liabilities associated with others.

- Joint ventures: Investors, co‑developers, and landowners often partner via SPVs to pool capital, share risk, and manage exit strategies.

- Structured financing: Real estate SPVs can raise debt (e.g., project finance, development loans) from institutional or cross-border lenders.

- Exit planning: Because of ring-fencing, it becomes easier to sell a single SPV (carrying a single property) without disturbing the rest of the group.

Given DIFC’s stature as a financial center with robust legal protections, these SPVs offer international investors confidence in their real estate exposure.

Structured Finance and Securitization

One of the most powerful uses of SPVs in global finance is securitization. In the DIFC context:

- SPVs can hold receivables (invoices, trade receivables, mortgages), which are then securitized into notes or certificates.

- They can act as the issuing vehicle for asset-backed debt, such as corporate debt, consumer debt, or project-based financing.

- In addition to traditional securitization, SPVs can be used for Sukuk issuance: Sharia‑compliant securities that are backed by asset cash flows, where SPV structure isolates risk and ensures proper structuring.

The stability and legal clarity of DIFC make it an ideal jurisdiction for these structured finance transactions, especially for cross-border or GCC‑centric sponsors.

Private Equity / M&A Structuring

SPVs are commonly employed in private equity and M&A deals for several reasons:

- Acquisition vehicles: Funds or sponsors establish SPVs to acquire target companies. This can simplify ownership, protect equity, and manage liabilities.

- Liability containment: Liabilities of the target are ring-fenced within the SPV, protecting the rest of the fund or group.

- Deal-specific structuring: For a particular deal, sponsors can create an SPV that holds the transaction’s assets and liabilities, making it easier to spin off, exit or refinance.

- Cross-border investment: Since DIFC SPV are recognized in an international legal context, they are particularly useful for private equity investments that involve multiple geographies.

Intellectual Property (IP) and Royalty Holding

Many companies, especially in technology, life sciences, and creative sectors, use SPVs to hold IP assets:

- A DIFC SPV can own patents, trademarks, software rights, or other intangible assets.

- The operating companies license the IP from the SPV, enabling ring-fencing of the valuable intangible assets.

- This structure protects IP from operational risk, ensures proper licensing governance, and provides clarity on transfer pricing or royalty flows.

Family Office & Succession Planning

For high-net-worth individuals and family offices, DIFC SPV are a flexible tool for:

- Wealth preservation: Holding key assets (shares, property, investments) in a ring-fenced SPV helps shield them from operational risk.

- Succession planning: SPVs facilitate multi-generational planning, enabling families to manage ownership, control, and exit mechanics in a structured and legally robust way.

- Global structuring: Families with cross-border assets appreciate DIFC’s legal certainty, making SPVs an effective vehicle for international holdings.

Emerging and Innovative Uses: What Will Define DIFC SPV by 2026?

While traditional use cases remain critical, the most exciting changes lie ahead. Here are the key trends that are likely to shape the SPV landscape in DIFC by 2026.

Tokenization of Real‑World Assets (RWA)

Tokenization is rapidly transforming global capital markets, and DIFC SPVs are uniquely positioned to play a central role as legal anchors of tokenized assets. Here’s how this trend could unfold:

- Legal versus on-chain representation: A DIFC SPV can hold the legal title to real-world assets (e.g., real estate, private equity, art), while tokens represent fractional ownership on-chain. The SPV acts as the issuer, bridging on-chain tokens to off-chain legal rights.

- Investor protection: By placing the legal title in a regulated, common-law SPV, investors can rely on established governance, audited financials, and legal recourse, while still participating via blockchain-native tokens.

- Custody and reconciliation: The SPV structure helps handle reconciliation between on-chain token holders and off-chain legal owners, ensuring a robust framework for investor claims, buybacks, or exits.

- Regulatory arbitrage: DIFC could become a preferred jurisdiction for token issuances because of its clarity, governance standards, and ability to support SPVs as legal issuers.

As institutional adoption of tokenized assets grows, SPVs will increasingly be viewed not just as passive companies, but as on‑chain/off‑chain hybrid issuers.

ESG-Linked and Sustainability SPVs

Sustainable finance has moved from being niche to mainstream, and SPVs will be critical in structuring ESG and impact‑linked investments:

- Green project SPVs: SPVs can be used to ring-fence green infrastructure projects (e.g., clean energy, carbon-credit assets), ensuring the right flows of cash, risks, and reporting.

- Sustainability-linked bonds: These SPVs can issue bonds whose coupons or principal are tied to ESG metrics (e.g., carbon reduction, social impact).

- Impact monitoring and governance: The SPV becomes the vehicle for tracking ESG KPIs, reporting to investors, and enforcing covenants.

- Blended finance: SPVs can combine concessional capital, private investment, and development funding to serve sustainability projects in emerging markets.

By 2026, ESG-aligned SPVs could become a significant portion of DIFC SPV activity, especially as global investors demand accountability and transparency.

Securitization of Alternative Asset Classes

Beyond traditional receivables or mortgages, SPVs will increasingly securitise less conventional assets:

- Subscription revenues: Recurring revenue business models (SaaS, subscription services) can securitize future cash flows.

- Intellectual property: Future royalty or licensing income streams can be securitized via SPVs.

- SME loans / local credit: SPVs can pool small business loans or micro-financing assets into structured products.

- Climate-linked assets: Carbon credits, biodiversity credits, or sustainability-linked future receivables could be packaged in SPVs.

- Royalty streams: Music, entertainment, publishing, and brand licensing royalties could be converted into tradable securities via SPVs.

By 2026, such asset-backed SPV issuances could scale significantly in the Gulf region via DIFC, tapping into global capital.

Family Offices, AI, and Quant Strategies

As family offices in the GCC become more institutional, a few niche but powerful use cases arise:

- AI-driven investment SPVs: Family offices using algorithmic strategies or quant funds may spin up SPVs dedicated to model-based investing, isolating risk in a legally ring-fenced vehicle.

- Multi-generational wealth structures: SPVs will continue to be used for succession planning, but with an overlay of data governance, distributed ownership, and smart governance.

- Venture investing: Family offices may create SPVs for venture capital, especially in blockchain, fintech, and green tech.

SPVs for philanthropy or impact investing: Combining family office wealth with ESG objectives via SPVs that issue sustainability-linked notes or impact securities.

These new models reflect how SPVs are no longer purely structural but can be dynamic vehicles for innovation, governance, and capital deployment.

Regulatory & Compliance Considerations for 2026

With great innovation comes heightened regulatory responsibility. Sponsors, advisors, and stakeholders will need to navigate a complex compliance terrain.

Maintaining the Passive Nature

One of the foundational principles of DIFC Prescribed Companies is passivity. Under the updated SPV regime, SPVs must remain passive holding vehicles or operate only for their defined “Qualifying Purpose.” (e.g., operational business, employees) may violate the regime and risk losing the intended benefits.

Director and CSP Requirements

- The mandatory appointment of a director from a DFSA-registered Corporate Service Provider (CSP) is critical. This CSP must also perform defined AML / compliance duties.

- Sponsors must ensure the CSP is well-versed in SPV governance, substance, and ongoing compliance.

Substance and Tax

- Given the UAE Corporate Tax regime and increasing scrutiny on substance internationally, SPVs must demonstrate genuine purpose, governance, and economic substance.

- For tax planning, structuring must address withholding implications, transfer-pricing, treaty access, and substance-based tax risk.

- Where the SPV issues debt or structured products, tax-efficient design will often rely on assessing cross-border investor profiles, cash flow waterfalls, and repatriation mechanics.

AML / KYC / UBO Transparency

- SPVs must meet DIFC and UAE AML/CTF (counter-terrorist financing) obligations.

- Beneficial ownership (UBO) structures must be transparent, and KYC due diligence must be rigorously applied.

- For tokenized issuances, on-chain investor onboarding must be aligned with off-chain legal ownership.

Disclosure and Documentation

- SPVs must maintain clear legal documentation (articles of association, shareholder agreements) that reflect the ring-fencing of assets and define investor rights.

- When SPVs are issuing notes / securities (especially tokenized), offering documents must clearly marry the on-chain rights with off-chain legal entitlements.

- Reporting mechanisms must be robust – investors (especially institutions) will demand audited financials, cash flow waterfalls, ESG KPI reports, and compliance updates.

Exit and Liquidation Strategy

- SPVs should have a well-defined exit strategy, whether via sale of the SPV, redemption, liquidation, or token buy-back.

- For tokenized SPVs, redemption or buy-back mechanisms need to map smart contract logic to legal processes.

- Insolvency planning is critical: ring-fenced SPVs must still plan for winding up, preferential claims, and creditor prioritization.

SPV Regime in DIFC: Risk Factors and Mitigation Strategies

As with any sophisticated structure, SPV sponsors must carefully assess and mitigate risk.

Regulatory Risk

- Change in regulation: While SPV regime in DIFC is stable now, further legislative changes could alter what is allowed.

Mitigation: Define flexible share and governance structures, and include step-in, amendment, or conversion rights.

- Regulatory arbitrage risk: If abuses occur, regulators may tighten rules. Mitigation: Maintain robust substance, KYC/AML, and governance.

Tax Risk

- Recharacterization risk: Cross-border tax authorities may challenge SPV structures.

Mitigation: Ensure real substance, board functions, audited accounts, economic justification.

- Withholding / treaty risk: If investors are from jurisdictions with withholding burdens, structuring must consider tax treaty access.

Mitigation: Use double tax treaty planning, careful cash flow planning.

Operational Risk

Misalignment between on-chain and off-chain rights: In tokenisation use-cases, if legal rights in the SPV do not align with the token smart contract, there could be investor disputes. Mitigation: Create detailed legal‑on‑chain mapping, involve legal counsel experienced in both blockchain and common-law structures.

Governance failures: Weak corporate governance could lead to mismanagement or misuse. Mitigation: appoint independent directors, set up investor protections, enforce covenants.

Reputation Risk

As SPVs become more visible (especially in ESG or tokenization), misgovernance or lack of impact might damage sponsor reputation. Mitigation: Transparent reporting, third-party assurance, ESG frameworks.

Liquidity Risk

Tokenized SPV securities might face liquidity constraints if on-chain trading infrastructure is immature. Mitigation: partner with regulated exchanges, create redemption / buy-back mechanisms, and educate investors.

Strategic Roadmap: How Sponsors and Advisers Should Prepare (2025–2026)

Given the evolving SPV regime and emerging use-cases, sponsors should proactively prepare. Here’s a 6‑step roadmap.

Define the Business Case

- Clearly articulate the purpose of the SPV: Is it for real estate, IP, tokenization, ESG, or structured finance?

- Perform a viability assessment: cash flows, investor demand, regulatory compliance, and exit strategy.

Engage Expert Counsel & Service Providers

- Hire a legal team with experience in both DIFC regulation and cutting-edge structures.

- Choose a CSP that is DFSA-registered and has strong compliance capabilities.

- Consider involving trustees or custodians early, especially for securitization or token use-cases.

Design the SPV Governance and Ownership Structure

- Draft articles of association that clearly define control, ring-fencing, and share rights.

- Incorporate investor protections: waterfall mechanisms, redemption clauses, governance vetoes.

- Appoint qualified directors (CSP-appointed, independent, or advisor-nominated).

Substance Building

- Establish a local presence (office, registered address, CSP).

- Maintain proper board meetings, minutes, financial reporting, and compliance procedures.

- Document all economic rationale, investor contributions, and transaction flows in detail.

Structure the Financial Mechanics

- For tokenized structures: map legal ownership to token architecture; define token economics, redemption, and compliance interface.

- For securitization: prepare waterfall models, priority of payments, credit enhancement, and legal documentation.

- For ESG structures: define KPI triggers, covenant enforcement, reporting cadence.

Plan for Exit, Liquidity & Wind‑Up

- Predefine exit mechanisms (sale, redemption, liquidation, token buy-back).

- Ensure legal and on-chain mechanisms align for tokenized SPVs.

- Create contingency plans for insolvency or changes in regulatory regime.

Predictions: What the DIFC SPV Market Will Look Like in 2026

Based on the trends, regulatory environment, and capital flows, here are my key predictions for where DIFC SPV will be by 2026:

Explosion of Tokenized RWA Issuances

- Real estate, private credit, and even non-traditional assets will see SPV-based tokenization.

- DIFC will become a go-to legal jurisdiction for token issuers targeting both traditional and crypto investors.

ESG / Impact SPVs Gaining Traction

- A significant portion of SPV issuance will be for sustainability-linked structures (green infrastructure, carbon assets, blended finance).

- ESG reporting and governance via SPVs will become standardized, attracting impact investors globally.

Alternative Asset Securitization

- Subscription business models, IP royalties, and climate-linked revenue streams will be securitized via SPVs.

- DIFC SPVs will serve as the legal wrapper for financial innovation in non‑traditional asset classes.

Family Office Adaptation

- More UHNW families will establish SPVs in DIFC for cross-border holdings, AI-driven investment, and legacy planning.

- Family offices will combine SPV structuring with tokenization and ESG aims, creating multi-generational impact vehicles.

Implications for Stakeholders

For Sponsors & Founders

- Opportunity: Use SPVs to raise capital through tokenization, access global investors, and structure risk efficiently.

- Challenge: They must be comfortable navigating both legal and technical complexity.

For Family Offices

- Opportunity: Build legacy structures combining wealth preservation, innovation, and impact.

- Challenge: Substance, governance, and compliance will matter more than ever.

For Investors

- Opportunity: Invest in tokenised or structured products with legal backing and transparency.

- Challenge: They will need to assess both on-chain mechanics and off-chain legal documents.

For Legal & Financial Advisers

- Opportunity: Offer high-value advisory on next-generation SPV structuring (tokenization, ESG, hybrid).

- Challenge: Build multidisciplinary capability: legal, tech, compliance, tax.

How Can MS Help in Setting up a SPV in DIFC?

MS offers comprehensive support for setting up a SPV in DIFC, ensuring a smooth and efficient process. From strategic structuring and regulatory guidance to incorporation and ongoing compliance, we help clients establish SPVs that meet DIFC and UAE requirements. Our expertise ensures proper governance, and alignment with investment or asset-holding objectives. With MS, your DIFC SPV is structured securely, fully compliant, and optimized to achieve your financial and operational goals.