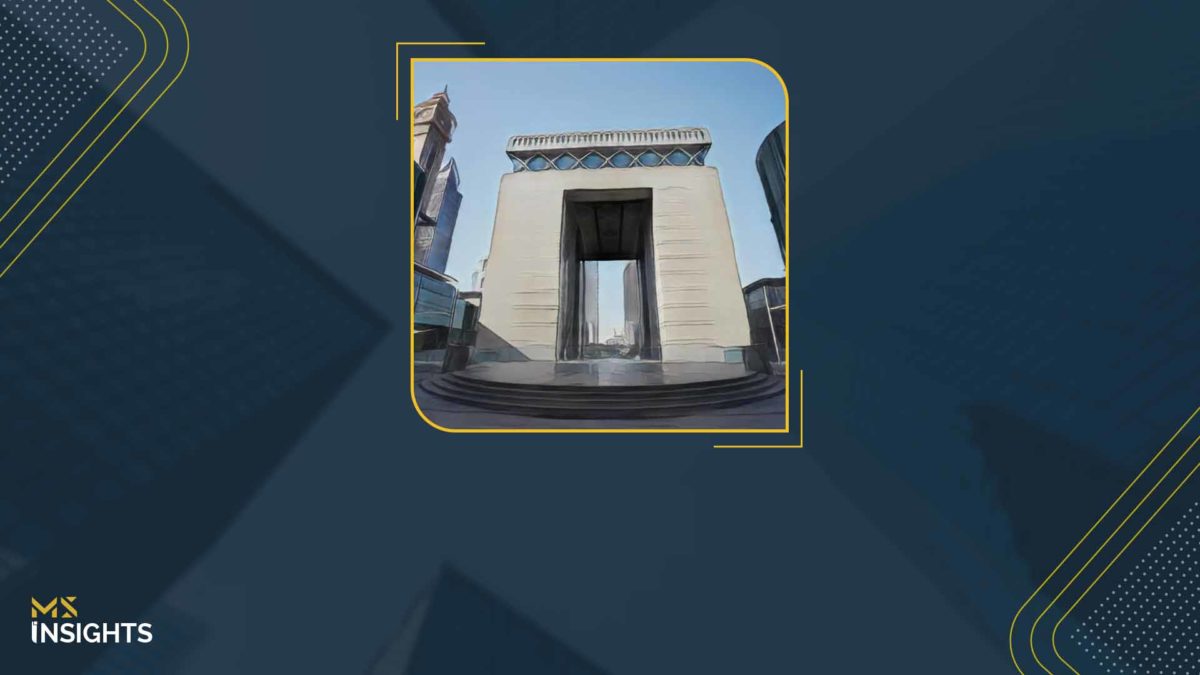

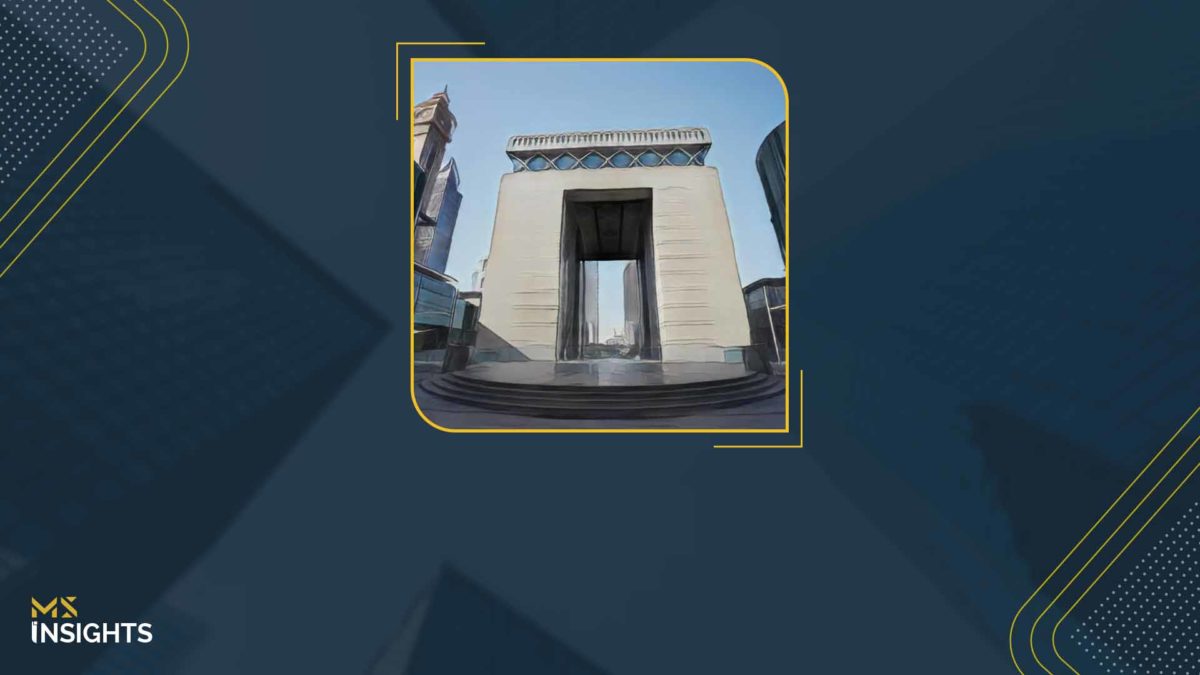

Dubai International Financial Centre (DIFC) is a dynamic ecosystem where innovation, finance, and lifestyle intersect. For those looking to setting up a company in DIFC, the financial centre offers not only regulatory and tax advantages but also an unmatched environment for networking, collaboration, and growth. The center’s world-class infrastructure, vibrant community, and global connectivity make it an attractive choice for businesses and professionals seeking both professional success and a high-quality lifestyle.

The Power of DIFC’s Community

One of DIFC’s most compelling features is its thriving professional community. From multinational corporations to boutique financial firms, and from fintech startups to advisory practices, DIFC attracts a diverse range of companies. This mix fosters collaboration, knowledge sharing, and business opportunities that are difficult to replicate elsewhere. Networking events, industry conferences, and informal meetups provide businesses with the chance to connect with potential partners, investors, and clients, cultivating relationships that drive growth.

By setting up a company in DIFC, you are being part of this ecosystem that gives employees access to a dynamic professional network. Regular seminars, workshops, and thought leadership events provide continuous learning opportunities, while proximity to leading financial institutions encourages idea exchange and innovation. For businesses, this environment creates a fertile ground for strategic partnerships and cross-border opportunities.

Setting Up a Company in DIFC: Lifestyle Benefits that Complement Business Growth

DIFC is designed not just as a financial hub but as a live-work-play environment. The district boasts high-end restaurants, art galleries, retail outlets, and wellness facilities that cater to an international community. Employees enjoy modern office spaces, green areas, and easy access to cultural and recreational activities. The ability to blend work and lifestyle seamlessly enhances talent retention and employee satisfaction, which in turn drives business performance.

For business leaders, this lifestyle advantage translates into better client engagement. Hosting meetings or events in DIFC’s sophisticated venues conveys professionalism and a commitment to quality, strengthening relationships and building trust with partners and clients. The integration of lifestyle and business in DIFC is a unique selling point for companies seeking to project a premium image in the region.

Setting Up a Company in DIFC: Key Considerations

While DIFC offers a wealth of opportunities, setting up a company in DIFC requires careful planning. Choosing the right company structure – be it a Limited Liability Company, a branch of a foreign company, or a Prescribed Company – is crucial. Each structure has its own regulatory obligations, operational flexibility, and suitability based on your business goals.

Compliance is another important factor. By setting up a company in DIFC, you must adhere to corporate governance standards, licensing requirements, AML/KYC regulations, and ongoing reporting obligations.

Maximizing DIFC’s Ecosystem for Growth

Once established, companies can harness DIFC’s ecosystem to accelerate their growth. Participation in industry forums, networking events, and innovation hubs facilitates connections with investors, partners, and talent. Access to cutting-edge facilities and business services streamlines operations, while the lifestyle-oriented environment attracts and retains top-tier professionals.

In addition, DIFC’s reputation as a global financial center enhances credibility and visibility. Businesses operating here benefit from international recognition, which can help open doors to new markets and partnerships across the Middle East, Europe, and beyond.

How MS Can Help You in Setting Up a Company in DIFC?

MS provides support for companies looking to establish themselves in DIFC. From selecting the optimal company structure to managing licensing applications, MS ensures that every step of your company setup in DIFC is seamless. Our team also advises compliance matters, corporate governance, and ongoing regulatory obligations, allowing businesses to focus on growth and networking within DIFC’s ecosystem.

With MS, companies can integrate into DIFC’s community efficiently, leveraging its professional networks, events, and lifestyle offerings while remaining fully compliant. This combination of regulatory guidance and ecosystem access creates a strong foundation for sustainable growth in the region.