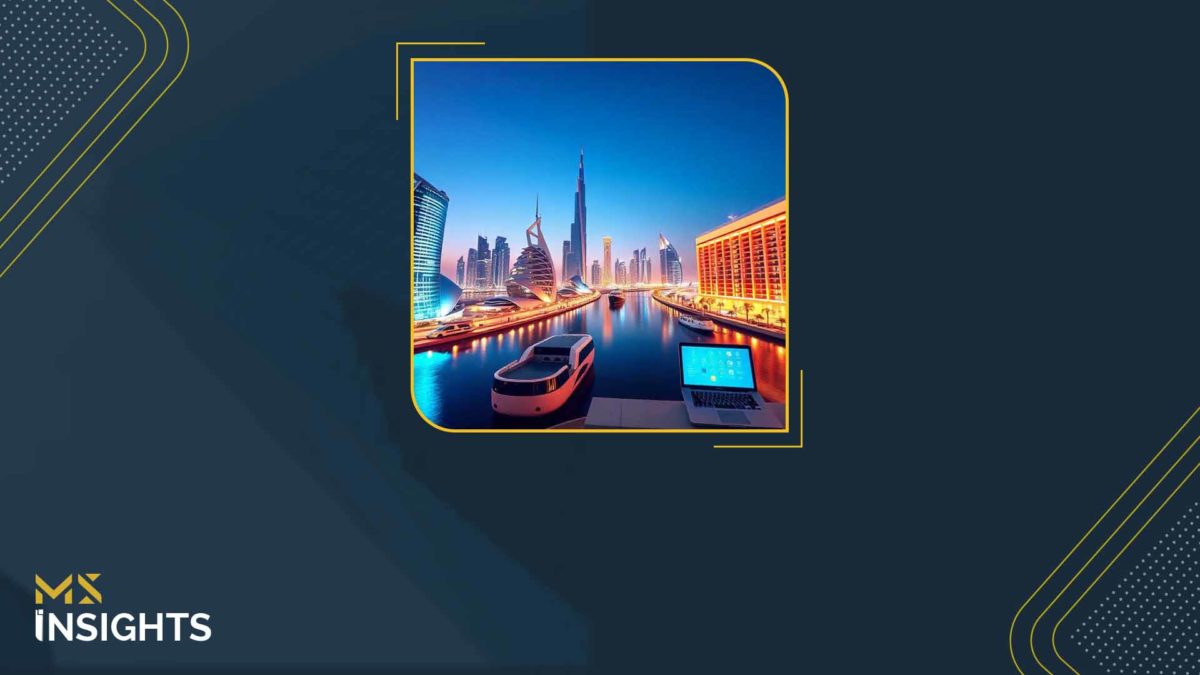

In 1971, the formation of the United Arab Emirates marked the beginning of an ambitious journey toward transformation and progress. What was once a collection of small trading ports has evolved into a global beacon of innovation and technology, with the UAE at its helm. Today, the country is standing shoulder to shoulder with the world’s renowned hubs like the US and UK, establishing the UAE as a global tech hub for emerging talent.

UAE as a global tech hub: a competitive choice for tech professionals

The findings from the Capital.com survey states that nearly half (45%) of Asian tech professionals expressed willingness to relocate to the UAE, placing it ahead of traditional tech strongholds like Germany and Hong Kong. This shift is crucial as the UAE now competes with established markets from around the world including the US, UK and Singapore.

The UAE’s increasing appeal is gaining traction among tech professionals who previously targeted the global tech hubs. The driving force behind this includes the UAE’s favourable business environment as well as the various government initiatives that ultimately boosts the status of UAE as a global tech hub.

The UAE’s strategic initiatives, such as the #NextGenFDI initiative, illustrate its commitment to attracting tech talent from around the globe. These efforts have not gone unnoticed, with professionals eager to relocate to a nation that meets their personal and career aspirations.

The Government’s Impact: Shaping the UAE as a Global Tech Hub

One of the most significant factors contributing to the UAE’s rise as a tech hub is its government’s unwavering support for the tech industry. From easing business regulations to investing in infrastructure, the UAE has created an ecosystem that nurtures innovation and entrepreneurship.

The UAE’s tech ecosystem is thriving and welcomes projects of all shapes and sizes. With a well-established network of free zones, starting and running a business here is not only straightforward but also tax efficient.

As a pioneer in AI, the UAE took a bold step by appointing the world’s first Minister of State for Artificial Intelligence. Now, Dubai is home to over 130 active AI initiatives, with companies applying AI in diverse fields like healthcare and media. This proactive government support is a key factor in positioning the UAE as a global tech hub.

The Emirates’ Strategic Role in Establishing the UAE as a Global Tech Hub

With the huge progress made in the tech sector, the UAE is expected to become on of the leading tech giants in the world by 2025.

Dubai

The Dubai is one of the leading cities in the world for its digital talent. The Dubai Intrenational Financial Centre (DIFC) had been attracting top talents from around the world and has been providing a favourable ecosystem for Tech businesses especially tech startups.

The incubators and accelerators like FinTech Hive and the Dubai Technology Entrepreneur campus offers facilities to startups, SME and entrepreneurs to easily start and scale their business ventures.

Dubai AI & Web3 Festival

The recently held Dubai AI & Web3 festival, underscored the UAE’s ambition to be at the forefront of technological advancements. The event attracted over 6,800 delegates from more than 100 countries, providing a platform for discussions on the commercial potential of AI and Web3 technologies. The UAE aims to bring in more than 500 companies and create over 3,000 jobs by 2028, reflecting the robust growth trajectory of its tech ecosystem.

“The UAE is a powerhouse for tech startups, offering unparalleled opportunities at every stage of growth. With robust support from the IFC and their dynamic incubators and accelerators, innovation thrives here. Events like AI & Web3 serve as vital platforms for networking and collaboration, igniting new ideas and partnerships.” Said Abdul Mirshan, Lead, Kitaab.ai (UAE-based virtual bookkeeping and accounting firm)

During the festival, the launch of the Dubai AI Licence and the ‘AI as a Service’ initiative highlighted the region’s commitment to attracting businesses and boosting their operations. These initiatives facilitate market entry for companies and cultivate a culture of innovation and collaboration among tech professionals, further solidifying the status of the UAE as a global tech hub.

Abu Dhabi

Abu Dhabi, the UAE’s second most populous city after Dubai, is setting its sights on becoming a tech leader in the region. the Abu Dhabi Global Market (ADGM) a leading IFC in the region, offers the ADGM tech startup license that enables tech companies to establish operations in the UAE quickly and easily.

Hub71, located within the Abu Dhabi Global Market, is celebrated as Abu Dhabi’s premier global technology ecosystem. Supported by the Abu Dhabi government and Mubadala Investment Company, Hub71 provides founders with a dynamic community to scale tech startups across various stages of development. The ecosystem encompasses over 20 business sectors, including fintech, health tech, ed-tech, climate tech, and AI, making it an ideal environment for innovation and growth.

The future of the UAE as a global tech hub: opportunities and innovations ahead

The UAE as a global tech hub is gradually shifting focus away from its non-oil activities, aiming to innovate and diversify its economy. It will undoubtedly attract more talent and drive technological advancements. The future looks promising, not only for the UAE but also for the global tech community that stands to benefit from this dynamic and rapidly evolving ecosystem. For tech professionals seeking new opportunities and challenges, the UAE is no longer just an option; it is a compelling choice that promises growth, innovation, and a bright future.