The Essentials

Foundations in the DIFC provide families and private clients with privacy, governance, and asset protection, keeping internal records confidential while complying with AML, UBO reporting, and data-protection rules. By 2026, the focus will be on stronger regulator access, enhanced data privacy, and digital-asset readiness balancing confidentiality with transparency.

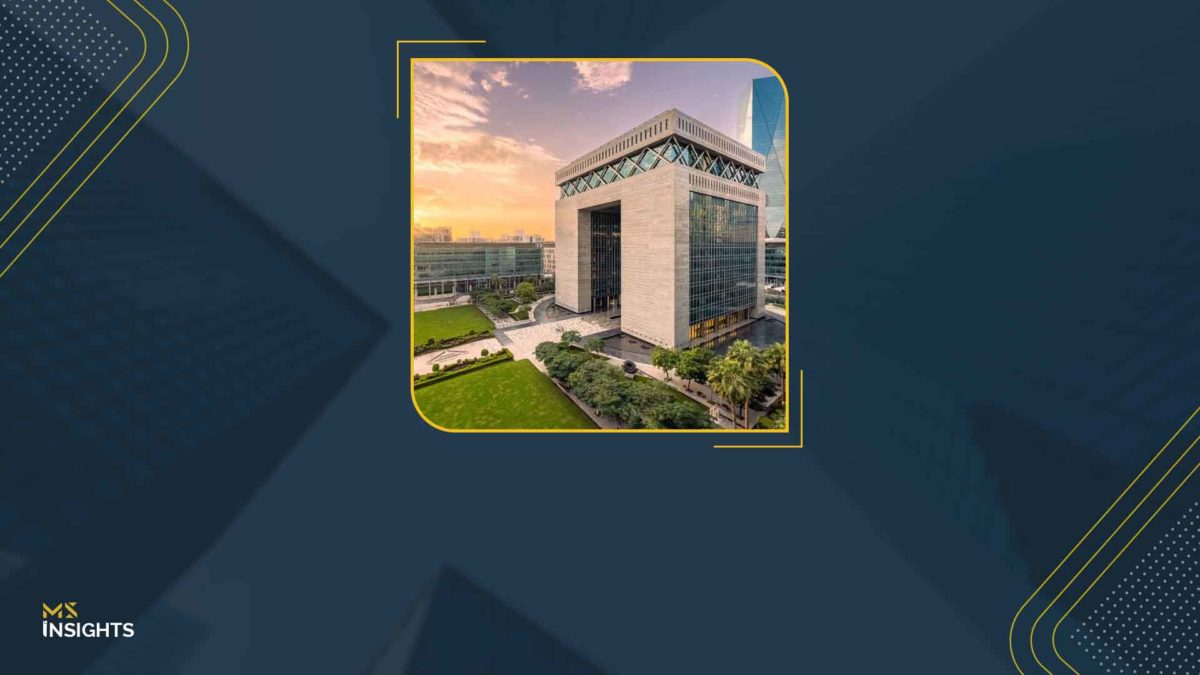

Foundations in the Dubai International Financial Centre (DIFC) have quickly become a favored structure for families, private clients and institutions seeking a formal vehicle that combines asset protection, succession planning and governance in a familiar common-law environment.

One of the defining attractions of foundations in the DIFC is the privacy they afford: founders, council members, guardians, and in many cases, beneficiaries do not appear on public registers in the way company directors or shareholders might. But that privacy sits beside an equally important requirement for transparency: international anti-money-laundering (AML) obligations, beneficial ownership reporting and evolving data-protection rules.

This tension – privacy for legitimate family-wealth reasons versus the public interest in preventing financial crime and enhancing governance is at the heart of contemporary debates about DIFC foundations.

Let’s explore the legal and practical architecture that underpins confidentiality in DIFC foundations, highlights the transparency obligations that temper that privacy, and looks forward to how the balance will evolve into 2026.

What is a DIFC Foundation and Why Privacy Matters?

A DIFC foundation is a legal person created under the DIFC Foundations Law (2018) and its operating regulations. It offers a hybrid of characteristics: like a company it has legal personality and can hold assets; like a trust it is often used for succession, estate planning and family governance. Importantly from a privacy perspective, the internal governance (the charter and by-laws), the identity of beneficiaries and the details of assets are not part of any public register accessible to the general public in the way that company registers are. Instead, foundations are required to register with the DIFC Registrar, but the information made publicly available is limited – the regime explicitly supports confidential, private wealth structuring.

Why this matters: for high-net-worth families, preserving confidentiality is often about more than privacy in a narrow sense. It reduces the reputational risk associated with public disclosures of family arrangements, limits solicitations or intrusion by third parties, and allows sensitive succession or charitable plans to be enacted without unwanted attention. DIFC’s English-language common-law environment and independent courts make it an attractive jurisdiction precisely because it blends enforceability with discretion.

Foundations in the DIFC: The Legal Architecture That Protects Confidentiality

The Foundations Law (DIFC Law No. 3 of 2018) and its Operating Regulations establish how foundations are formed, governed and wound up. The regime deliberately creates a separation between the foundation’s internal records (charter, by-laws, beneficiary lists) and public disclosure. Founders and beneficiaries are generally treated as private; the charter can specify who receives information and on what terms. Practical confidentiality is maintained because DIFC foundations do not require the same level of public filing as corporate entities.

Additionally, DIFC’s family and private wealth offering supplements the legislative architecture with regulatory guidance and checklists for non-financial due diligence specific to family offices and foundations. These materials aim to ensure that privacy does not become a vehicle for evasion of AML/CTF duties while preserving legitimate confidentiality.

Transparency Requirements That Limit Absolute Secrecy

Privacy is not absolute. The DIFC operates within a global regulatory ecosystem shaped by Financial Action Task Force (FATF) standards, EU and UK de-risking trends, and local UAE AML frameworks. Several mechanisms constrain the extent of confidentiality:

- Registrar and Beneficial Ownership Reporting – While the foundations’ charter and beneficiary lists are not publicly searchable, foundations in the DIFC must maintain accurate ultimate beneficial ownership (UBO) records and provide them to the Registrar or competent authorities on request. The DIFC’s Ultimate Beneficial Ownership Regulations and related reporting frameworks require foundations to keep non-public registers that can be accessed by regulators and law enforcement.

- AML/CTF compliance – Foundations fall within the AML/CTF perimeter: service providers (family offices, trust companies, advisors) must carry out customer due diligence, transaction monitoring and suspicious activity reporting where relevant. This requires the collection and retention of identity information about founders, controllers and beneficiaries albeit in confidential registers rather than public portals.

- Cross-border information exchange – DIFC entities are not immune from international information requests. Where law enforcement or competent authorities demonstrate proper legal process, private registers can be disclosed. The balance between privacy and cooperation with foreign authorities is an evolving area of practice and policy.

These mechanisms demonstrate that foundations in the DIFC offer a high level of privacy for legitimate wealth-management reasons but are designed to resist misuse by providing regulators with access to the necessary ownership and control information.

Recent Reforms and the 2024–2025 Trendline

The DIFC has actively refreshed its legislative framework in recent years to remain future-proof. Notable developments include consultations and amendment packages that modernize the foundations and trust framework and align DIFC law with digital asset developments and enhanced data privacy standards. DIFC foundations continue to protect confidential family information, and regulators have strengthened measures that improve access for AML and supervisory purposes.

In mid-2025, the DIFC introduced amendments and guidance aimed at bolstering data privacy and clarifying registrar access and reporting procedures. These actions align DIFC law with global best practice and reflect a willingness to be more transparent to competent authorities while protecting family privacy from public exposure.

Foundations in the DIFC: Practical Measures for Families and Advisers to Protect Confidentiality

Creating privacy that is also resilient to regulatory scrutiny takes planning. Practical steps advisers and founders typically use include:

- Charter drafting with precision – The foundation charter and by-laws should precisely set out who has access to which records, under what circumstances, and any graduated information rights for beneficiaries. It can also specify notification triggers for changes, distributions and oversight. This reduces ambiguity and strengthens the legal basis for confidential treatment.

- Robust UBO record management – Keep accurate, contemporaneous non-public registers and documentary evidence of UBO identity and control. Ensure the foundation’s service providers maintain secure, access-controlled systems for these records so they can be disclosed quickly to legitimate authorities without public leakage.

- AML and compliance by design – Integrate AML/CTF processes into the foundation’s lifecycle: onboarding, periodic reviews, transaction monitoring and suspicious-activity escalation. This approach demonstrates good governance and reduces the likelihood that privacy will be compromised by regulatory intrusion.

- Data protection and cybersecurity – The recent data privacy focus in DIFC law makes it prudent to adopt privacy-by-design principles, strong encryption, role-based access controls and documented data-subject request procedures where applicable. Adopting such measures shows respect for individual rights while safeguarding confidential family data.

- Use of professional intermediaries – Experienced DIFC trust and corporate service providers, family office managers, and DIFC-licensed lawyers are often better placed to negotiate the balance between confidentiality and compliance. Their institutional processes reduce operational risk and create a documented chain of decisions.

The 2026 Outlook for Foundations in the DIFC: Where Privacy and Transparency are Heading

Looking toward 2026, several converging trends will shape the confidentiality–transparency balance for foundations in the DIFC:

More granular regulator access, not public exposure – Expect DIFC and UAE authorities to continue improving the mechanisms by which competent authorities access non-public UBO and governance information. The direction is toward more efficient, secure information exchange with regulators and law enforcement – not toward full public disclosure of foundation beneficiaries. This preserves the core value proposition of foundations for private wealth while addressing international AML concerns.

Data-protection sophistication – As DIFC aligns with global data-privacy trends, foundations will be subject to clearer obligations on data handling, retention limits, and data subject rights. In practice this will mean more formalized DSR (Data Subject Request) procedures, strengthened cybersecurity expectations and more contractual attention to cross-border transfers matters advisers must incorporate into foundation governance.

Digital assets and tokenized wealth – DIFC’s interest in digital asset laws means foundations that hold tokenized assets or that run family wealth structures with digital exposure must address custody, provenance and identity issues. Tokenization increases transparency possibilities (public blockchains) and privacy risks (linkages between public addresses and private beneficiaries), so foundations used for digital assets will need bespoke governance rules that reconcile blockchain transparency with legal confidentiality.

Policy and Reputational Risk: What Families Must Watch For?

Privacy arrangements always carry reputational risk if they are perceived as instruments to hide wrongdoing. Families and advisers should therefore:

- Avoid any perception of secrecy for secrecy’s sake; adopt transparent governance with documented rationale for confidentiality.

- Ensure AML/CTF processes are demonstrably robust and independent service providers are used for sensitive functions.

- Keep communication strategies ready so that, if legitimate inquiries arise (media, regulators, counterparties), the family can explain the structure, its purposes and the compliance safeguards in place.

- DIFC’s position – privacy within a regulatory perimeter – is designed to reduce these reputational risks by enabling regulator access while preventing public exposure of family details.

Practical Checklist for Establishing a Privacy-Resilient Foundations in the DIFC

- Draft charter/by-laws that specify information rights, disclosure triggers and governance escalation procedures.

- Maintain detailed, access-controlled UBO and beneficiary registers; appoint a DIFC-licensed custodian for records.

- Implement AML/CTF compliance and periodic audits; document decisions and due-diligence outcomes.

- Adopt data privacy policies and cybersecurity measures aligned with DIFC data-protection updates.

- Use independent professional advisers (DIFC counsel, regulated family office or trust company) to manage disclosures to competent authorities.

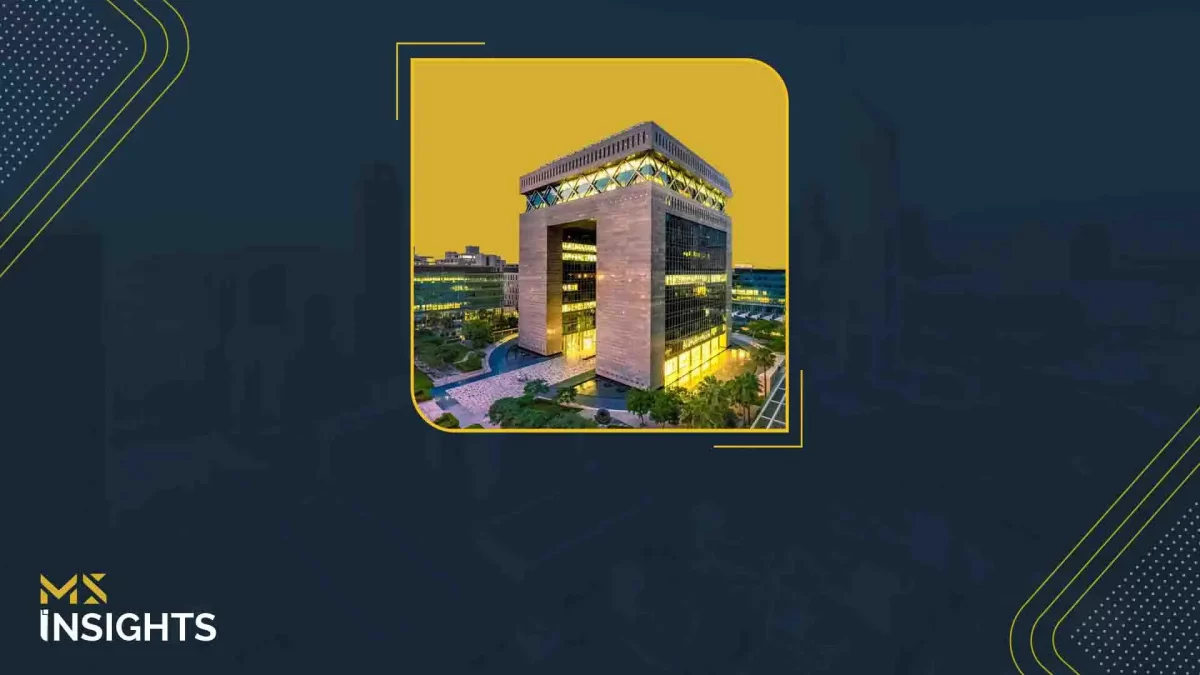

How MS Can Help in Setting Up Foundations in the DIFC?

At MS, we guide clients through the entire DIFC Foundation setup journey, ensuring both compliance and confidentiality. Our services include:

- Tailored Structuring Advice: We help define the foundation’s objectives, governance, and beneficiary arrangements to align with your wealth management, succession, or philanthropic goals while maintaining optimal privacy.

- Charter and By-Law Drafting: Our legal experts prepare precise foundation charters and by-laws that establish clear governance rules, information rights, and disclosure triggers.

- Regulatory Compliance: We ensure full adherence to DIFC Foundation Law, AML/CTF regulations, and beneficial ownership reporting requirements, keeping your foundation regulator-ready without compromising confidentiality.

- Professional Registrar Assistance: From registering the foundation with the DIFC Registrar to managing filings and documentation, we handle all procedural aspects seamlessly.

- Ongoing Administration and Advisory: MS offers trusted support for council management, trustee or guardian appointments, record-keeping, and periodic reviews to maintain privacy and compliance over the foundation’s lifecycle.