For globally mobile families, preserving wealth is just the beginning. The greater challenge lies in sustaining unity, purpose, and legacy across generations and borders. As family structures grow more complex and assets span multiple jurisdictions, the risk of misalignment, internal disputes, and erosion of shared values increases.

Let’s explore the common pitfalls that can undermine effective succession planning for global families and how proactive governance, clear communication, and the support of sophisticated family office structures

The Hidden Fault Lines in Succession Planning for Global Families

1. Succession Disputes Are Common, Even Among Ultra-Wealthy Families

In globally mobile families, members are often dispersed across multiple countries, each with its own inheritance laws, tax regimes, and regulatory frameworks. Without a unified governance structure, these conflicting rules can create confusion over rights and responsibilities. The result? Disputes, delays, and costly legal battles that can erode not only the financial value of the estate but also the trust and cohesion within the family. For effective succession planning for global families, cross-border alignment is essential to avoid unintended consequences and preserve both wealth and harmony.

2. Lack of Clear Governance Leads to Costly Legal Battles

Global families often have members spread across multiple countries, each with different inheritance laws, tax systems, and regulations. Without a unified governance framework, conflicting rules can cause confusion and disputes over rights and responsibilities. This complexity often results in protracted legal battles, significant costs, and unintended tax consequences, undermining the value intended to be passed on.

3. Legacy Is More Than Just Money

Legacy encompasses more than financial assets. It includes a family’s identity, values, name, culture, and long-term vision. When succession planning focuses solely on the transfer of money, the family risks losing the core principles and story that give meaning to their wealth. Without this broader perspective, heirs may lack a sense of stewardship and responsibility, leading to disengagement or misuse of family resources.

4. Succession Planning Is Treated as a One-Time Event

Succession planning for global families is approached as a single, static event rather than an ongoing, dynamic process. Families grow, change, and experience life events, while laws and market conditions evolve. If succession plans are not regularly revisited and updated, they become outdated, misaligned with current family realities, and potentially legally ineffective.

5. Communication Gaps Between Generations Create Misunderstandings

One of the biggest challenges in succession planning for global families is the lack of open, honest communication between generations. Senior family members may withhold information to protect younger generations, while heirs may feel excluded and undervalued. This communication breakdown fosters assumptions, resentment, and surprises that can damage trust and relationships once wealth and leadership change hands.

6. Lack of a Family Constitution or Charter Leaves Intentions Unclear

Without a formal family constitution or charter to capture shared values, governance rules, and conflict resolution mechanisms, succession intentions can be ambiguous. Legal documents such as wills or trusts may dictate asset distribution but rarely reflect the family’s collective vision or provide clear guidance on behavior and decision-making, increasing the risk of disputes.

7. Standard Structures Don’t Accommodate Cross-Border Heirs

Global families face significant challenges when heirs reside in different jurisdictions with varied tax laws, inheritance rules, and compliance requirements. Relying on standard wills or generic trust arrangements can expose families to unintended tax liabilities or legal complications, reducing the effectiveness of wealth transfer and potentially triggering conflicts among heirs.

8. Modern Family Dynamics Add Legal and Emotional Complexity

Families today are diverse, with blended households, stepchildren, second marriages, and different cultural or religious backgrounds. These factors complicate legal entitlements and expectations. Ignoring such dynamics in succession planning risks exclusion, unfairness, or emotional friction that can disrupt the family’s unity.

9. Lack of Education and Engagement Among Heirs Weakens Legacy

Even the most carefully structured succession can falter if heirs lack the knowledge, skills, or engagement to manage their inheritance. Many heirs remain unaware of the family’s wealth structures or business interests, leading to mismanagement or disconnection. Without deliberate education and involvement, the family’s legacy may be lost within a generation.

10. Equal Doesn’t Always Mean Fair in Inheritance

While equality is often perceived as fairness, it may not reflect individual circumstances such as personal capabilities, contributions to the family enterprise, residency, or tax considerations. Applying an equal distribution without nuance can cause feelings of injustice and resentment, fracturing family harmony.

How UAE Family Offices Strengthen Succession Planning for Global Families?

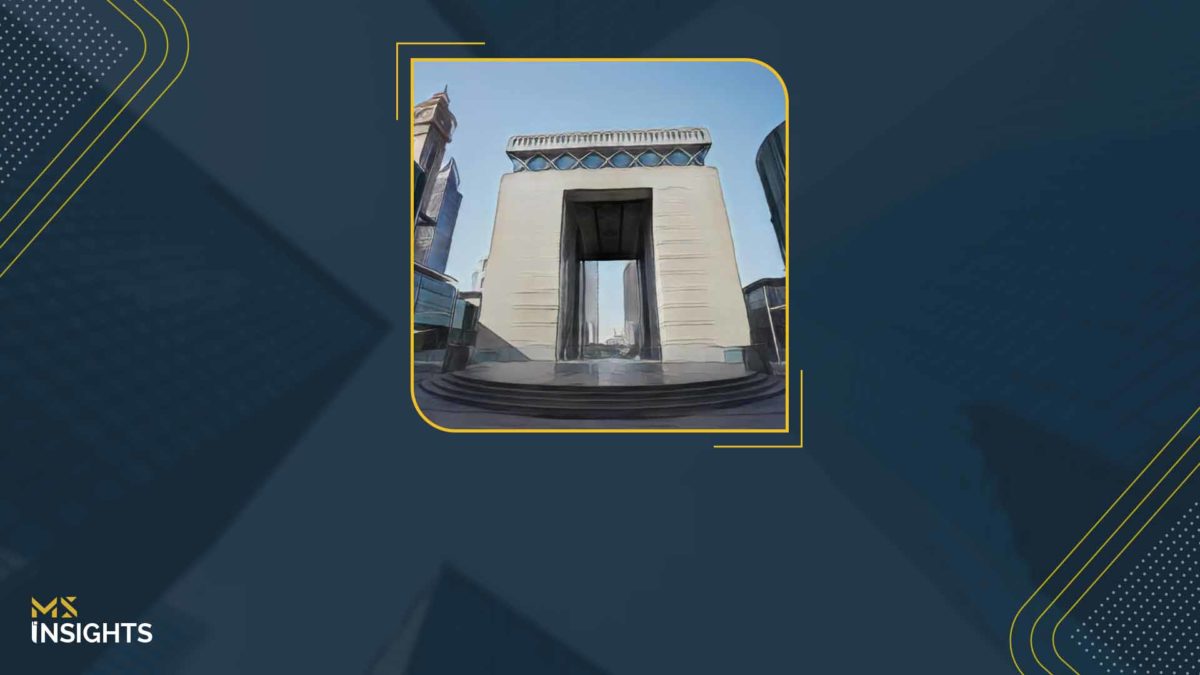

UAE-based family offices, particularly within frameworks like DIFC and ADGM, offer a robust platform for succession planning for global families. Beyond wealth administration, they help families institutionalize values, identity, and long-term vision through governance tools such as family charters and constitutions. With access to multidisciplinary experts, these offices design bespoke structures like trusts and foundations that address cross-border legal, tax, and residency considerations. They also foster transparency, generational dialogue, and education, critical for reducing disputes and aligning expectations. In an increasingly complex global environment, UAE family offices provide the stability, confidentiality, and strategic foresight needed to ensure smooth transitions and sustained legacy.

MS: Supporting Succession Planning for Global Families Through UAE Family Offices

At MS, we specialize in establishing and managing sophisticated family office structures in leading jurisdictions like DIFC. Our team brings deep cross-border expertise to help families design governance frameworks that reflect their unique values, vision, and long-term goals. We assist in drafting family constitutions, implementing tailored trusts and foundations, and advising on residency, tax, and succession planning for globally dispersed heirs.