UAE foundations have rapidly evolved into a mainstream vehicle for business continuity, intergenerational wealth planning, and tax efficiency. Once considered a niche structure, foundations are now at the forefront of asset protection and succession strategies, attracting individuals and businesses seeking long-term stability.

The strength of a DIFC Foundation setup lies in its governance framework, which balances asset protection with the founder’s long-term vision and operational efficiency. This structure is upheld by key roles such as the Founder, who establishes the foundation; the Council, responsible for overseeing its operations; and the Guardian, who provides an extra layer of oversight when required. Additionally, Beneficiaries and a Default Recipient play crucial roles in asset distribution and continuity planning.

Let’s break down these key governance roles, explaining their responsibilities and significance in making DIFC Foundations an essential tool for long-term wealth and business planning.

Who Runs the DIFC Foundation Setup? Key Roles and Responsibilities

Founder

The Founder is the individual or entity that establishes the DIFC foundation setup and provides its initial assets. Unlike other corporate structures, DIFC Foundations do not have a share capital requirement, meaning there is no minimum contribution needed. The founder sets out the foundation’s purpose and structure, ensuring that it aligns with their long-term vision, whether it’s for wealth preservation, family succession, or philanthropy.

Council

The Council is responsible for managing the foundation’s assets and ensuring its objectives are met. This governing body plays a pivotal role in decision-making and administration. Key governance points include:

- A council must have at least two members, who can be individuals or corporate entities.

- The Founder is permitted to be a council member.

- A council member cannot also serve as the Guardian to maintain oversight and accountability.

Guardian (Optional)

The Guardian serves as an oversight role, ensuring that the foundation operates according to the founder’s wishes. This role is optional except in cases where the DIFC foundation setup has charitable or specific non-charitable objects, where it becomes a mandatory position. A Guardian can be either an individual or a corporate entity.

Beneficiaries/Qualified Recipients

Beneficiaries (also known as Qualified Recipients) are the individuals or entities designated to benefit from the foundation’s activities. These may include family members, charities, or other organizations chosen by the founder. Interestingly, the founder can also be a beneficiary, allowing them to retain some benefits from the structure while ensuring the foundation’s long-term sustainability.

Default Recipient

The Default Recipient is an essential safeguard in DIFC Foundation setup. This individual or entity receives the foundation’s remaining assets in case it is wound up and no specific beneficiaries are identified. This role ensures that assets are properly distributed and do not remain unclaimed, preserving the integrity of the foundation.

DIFC Foundation Setup: A Flexible and Secure Solution for Wealth and Business Structuring

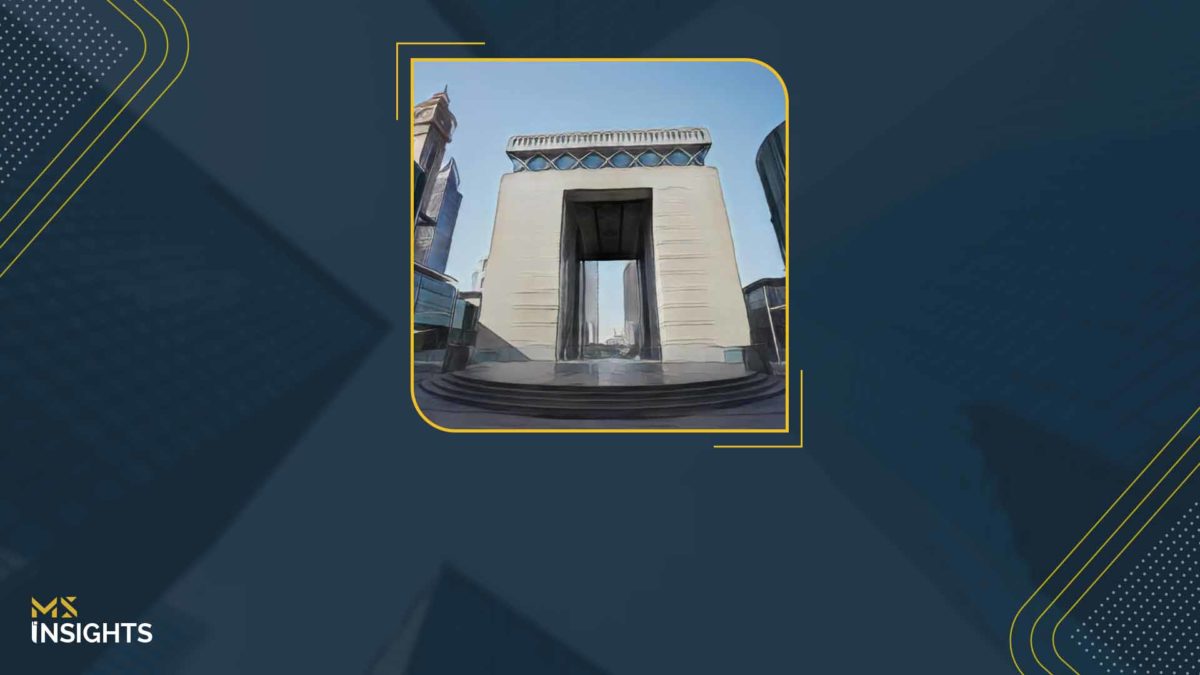

DIFC Foundations provide a sophisticated and flexible structuring solution, offering a distinct legal personality separate from their founders. Governed by DIFC laws, they ensure strong legal protection and governance, with limited exceptions. These exceptions arise when assets are located outside DIFC, and the founder’s ability to transfer them is restricted by the jurisdiction where the assets reside.

They are particularly advantageous for high-net-worth individuals and families with assets across multiple jurisdictions, ensuring seamless succession planning. With DIFC’s well-developed ecosystem supporting financial and non-financial businesses including wealth management, legal advisory, and corporate services it remains a premier jurisdiction for establishing and managing foundations.

Effortless DIFC Foundation Setup with MS: Secure, Compliant, and Tailored to Your Goals

At MS, we make setting up a DIFC Foundation effortless, offering comprehensive support from start to finish. As a registered corporate service provider in DIFC, we take care of the entire process, ensuring full compliance with regulatory requirements. Our customized approach ensures your DIFC foundation setup is structured to align with your goals whether for wealth preservation, succession planning, or philanthropy. With MS as your trusted partner, you can secure, grow, and seamlessly transfer your wealth for generations to come. Let us guide you in unlocking the full potential of DIFC Foundations with expert insight and dedicated support.