Special Purpose Vehicles (SPVs) are passive holding companies established for the purpose of isolating financial and legal risk by ring-fencing certain assets and liabilities. It is a private company limited by shares, similar to a UK limited company or a C-Corp in Delaware, established by shareholders for specific purposes, typically to hold shares in other companies. Often, it merely holds shares in the operating companies or subsidiaries responsible for conducting the startup’s business activities. ADGM SPVs have gained popularity as the preferred choice for holding companies among startups and investors in the MENA region.

WHY ADGM SPVs?

The choice of ADGM SPV is essential due to the rising regulatory scrutiny, increased risk exposure, and complex cross-border transactions. It’s crucial to segregate financial and legal risks by isolating assets and liabilities associated with specific transactions. This segregation is necessary to safeguard the integrity of these transactions and the assets intended for corporate or private use. SPVs serve a variety of narrow, specific, or temporary corporate and private family objectives, including acting as subsidiaries, project or joint venture entities, facilitating financing, sharing risks, raising capital, structuring intellectual property rights, functioning as holding companies, and providing real estate protection structures.

A non-substantiated vehicle (SPV, special purpose vehicle), which is a free zone company, to conduct “Exempt activities” pursuant to the ADGM Special Company Regulations such as:

- Acquisition, holding or disposal of any asset;

- Securitizing assets, Investing in UAE real estate property;

- Issuing investments;

- Redeeming or terminating or repurchasing, whether with a view to re-issue or to cancel, an issue in whole or in part, of investments;

- Entering into transactions or terminating transactions involving investments in connection with the issue, redemption, termination or re-purchase of investment.

Why the adgm as international financial center for spvs?

- Top tier financial center with numerous international memorandums of understanding in place facilitating international recognition

- Part of oecd & eu white lists of tax cooperative jurisdictions

- Common law jurisdiction: common law of england and wales on civil and commercial matters directly applicable which provides high level of legal certainty and reliability. Adgm spvs are subject to the adgm companies regulations 2015

- Independent adgm courts

- Best-in-class risk based independent regulatory framework

- Adgm’s three independent authorities (registration authority, financial services regulatory authority and adgm courts) provide a consistent, reliable and stable legal environment enabling registered companies to conduct business in confidence

- Access to broad uae double tax treaty network (subject to meeting requirements as set out by ministry of finance to obtain tax domicile certificate)

- No attestation required for corporate documents

- Spvs are granted a commercial licence mentioning that the company is conducting special purpose vehicle activities

- Use of standard form of transactional documentation for increased efficiency

- Tax benefits:

- 0% direct tax

- 0% withholding tax

- No restriction on repatriation of capital

- No foreign exchange controls

- Access to uae network of double tax treaties

ADVANTAGES OF AN ADGM SPVs

- SPVs are corporate vehicles, typically private companies limited by shares, incorporated to segregate financial and legal risk by ring-fencing assets and liabilities to avoid systemic risk within a Group of Companies – claims made by the SPV’s creditors cannot be attached to the assets of the SPV’s shareholders or any of its sister companies – and ensure that only assets attached to a related transaction are exposed to the associated liabilities.

- SPV serves to fulfill narrow, specific,, or temporary corporate objectives such as subsidiaries, project or joint venture vehicles, and holding companies.

- SPV’s cost-effective, straightforward setup process, due diligence procedure & reporting requirements. However, a more limited public disclosure requirement can be met by the use of a ‘Restricted Scope Company’ SPV.

- SPV can use the registered address of an ADGM registered agent, its ADGM parent company’s address.

- A Foreign company can re-domicile/ migrate to ADGM pursuant to section 102 (application to Registrar for continuance within ADGM for the issuance of a certificate confirming that it continues as a company registered pursuant to ADGM Companies Regulations) in appliance with main jurisdictions ‘legislations such as BVI, Cayman Islands, Jersey and Guernsey.

USES OF ADGM SPVS

1. Securitisation:

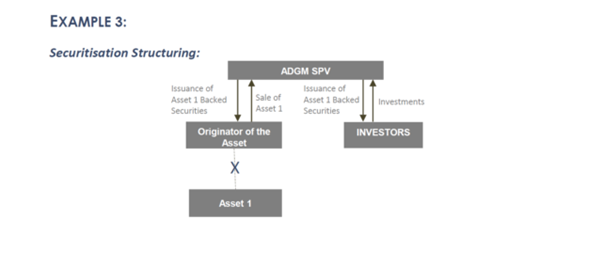

ADGM SPVs can be utilized for securitisation purposes, where the originating party can create an SPV to purchase loans or receivables. The SPV issues debt, secured by these assets, ensuring priority payment rights for asset-backed securities holders. This setup limits recourse to the asset originator.

2. Real Estate Investment:

ADGM SPVs can acquire real property titles, limiting recourse for mortgage lenders based on the asset’s location. Selling SPV shares in some jurisdictions can result in lower taxes and transaction fees compared to transferring the property directly.

3. Financing:

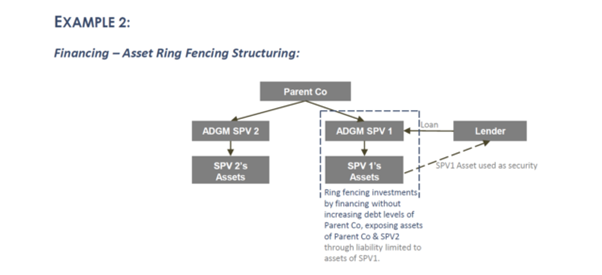

SPVs help ring-fence investments, enabling financing without increasing parent company debt levels or exposing parent or SPV assets to cross-liabilities.

4. Asset Transfer:

SPVs facilitate asset transfers along with material agreements. This allows the transfer of ownership while preserving essential agreements crucial to maintaining the asset’s value.

5. Risk Sharing:

SPVs can form project companies for joint ventures, defining management responsibilities while legally isolating joint venture partners from associated risks.

6. Raising Capital:

SPVs can raise capital at favorable rates, with creditworthiness determined by the SPV’s collateral, not the parent company’s credit rating.

7. Intellectual Property (IP):

SPVs can separate valuable IP into standalone entities with minimal liabilities. These SPVs can raise funds and engage in license agreements with third parties. They are particularly useful for managing products with diverse IP components.

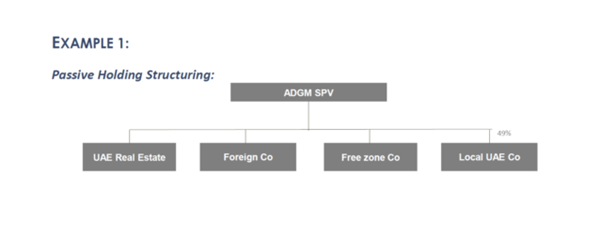

Eg 1: Passive Holding Structuring using ADGM SPV (ADGM Special Purpose Vehicle)

Eg 2: Financing – Asset Ring Fencing Structuring: Using ADGM SPV (ADGM Special Purpose Vehicle)

Eg 3: Securitisation Structuring: Using ADGM SPV (ADGM Special Purpose Vehicle)

RESTRICTION OF SPVs:

1. Passive Activities Only:

An ADGM SPV is limited to passive activities and cannot conduct commercial operations. It cannot engage in operational activities. The restriction is specific to the holding company’s operational aspect, such as offering consultancy-related services, manufacturing, real estate-related advisories etc and invoicing. These restrictions do not affect its capability to receive funds as dividends.

2. Ownership without Operation:

While it can own shares in operating companies or subsidiaries, an ADGM SPV cannot actively operate or manage the businesses it owns.

3. No Employee Engagement:

ADGM SPVs are prohibited from having employees. This means they cannot hire staff or issue work visas.

4. Limited Commercial Engagements:

They are not allowed to enter into any commercial agreements with customers or suppliers. This includes restrictions on renting office spaces or engaging in direct customer transactions.

5. Financial Transactions Permitted:

Despite limitations, ADGM SPVs can open bank accounts and receive funds. They can handle financial matters, including receiving investment funds or dividends from their subsidiaries.

In the ever-evolving landscape of international business, the strategic significance of ADGM SPVs becomes apparent as a vital foundation. These vehicles offer startups and investors in the MENA region a sophisticated framework that goes beyond the conventional. From facilitating securitization to enabling real estate investments, ADGM SPVs showcase their versatility, providing not just financial structuring but also adept risk mitigation.

What sets ADGM SPVs apart is the commitment of the ADGM to provide legal clarity, coupled with the allure of tax benefits. Positioned as a top-tier financial center, the ADGM underscores the importance of SPVs as the preferred choice for those navigating the intricacies of cross-border transactions amidst heightened regulatory scrutiny.

In essence, ADGM SPVs emerge not just as financial instruments but as strategic allies, seamlessly navigating complexities and providing a robust foundation for startups and investors in the MENA region.