The Essentials

DIFC continues to be the premier hub for UHNWIs and family offices in 2026, offering regulatory certainty, tax efficiency, and a strong wealth ecosystem. Company formation in DIFC helps families manage assets, governance, and succession seamlessly. MS provides expert guidance to make the process smooth, strategic, and future-ready.

As global wealth continues to migrate and multiply, Ultra‑High‑Net‑Worth individuals (UHNWIs) and family offices face increasingly complex questions: Where should they base their wealth? How can they preserve it across generations? And how can they structure their holdings to seize investment opportunities across borders?

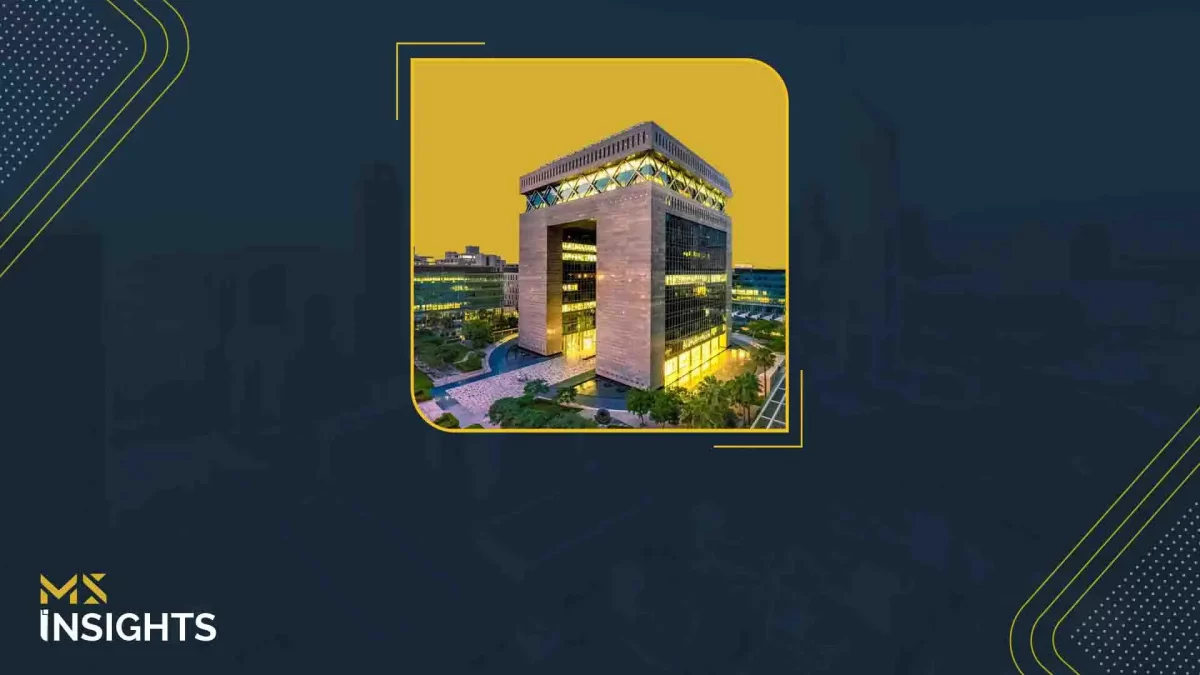

The Dubai International Financial Centre (DIFC) has emerged as the answer to these questions – not merely as a financial district, but as a purpose-built hub that combines regulatory certainty, tax efficiency, and a robust ecosystem tailored for family offices. With specialized frameworks for succession planning, privacy, and access to alternative investments, DIFC allows families to manage and grow their wealth in a structured, secure, and globally connected environment.

Looking toward 2026, DIFC’s appeal is only set to strengthen. Its world-class infrastructure, investor-focused reforms, and vibrant network of advisers, wealth managers, and private markets make it the go-to destination for families seeking not just to preserve wealth, but to actively expand it. By company formation in DIFC, families can effectively structure and manage their assets, implement robust governance, and plan for multigenerational continuity.

1. Regulatory and Legal Framework: The Foundation of Trust

One of the foremost considerations for UHNWIs and families is legal and regulatory stability. Establishing a company in an unfamiliar or volatile jurisdiction creates risk. DIFC offers at least four major advantages in this regard:

a) Common‑law framework and independent judicature

DIFC operates under English common law principles and features an independent court (the DIFC Courts). This familiarity is attractive for international investors, especially from the UK, Europe, India and other common‑law jurisdictions. It helps ensure predictability of contracts, enforceability of rights, and recognition of international structures.

b) Tailored regulation for family wealth, foundations, holding companies and single‑family offices

DIFC has introduced dedicated frameworks such as the DIFC Family Wealth Centre (DFWC) and the “Family Arrangements Regulations 2023” (formerly known under other names) that specifically address succession planning, multi‑generational governance and privacy. These frameworks give families comfort that their structures, if formed in DIFC, are governed by bespoke rules that cater to their unique needs (rather than being forced into generic corporate regimes).

c) Privacy, succession‑planning and inter‑generational continuity

The family arrangements regulations in DIFC include options such as a private registry for enhanced discretion. That means families forming a company or holding structure in DIFC can implement advanced estate‑planning, governance and generational‑transfer mechanisms while maintaining confidentiality, a key requirement for many UHNWIs.

d) Growth‑oriented regulation with global benchmarking

DIFC has demonstrated agility in evolving its regulatory regime in line with global best practice. For example, the DFWC accreditation for advisors, the launching of the Family Wealth Centre, and other enhancements reflect responsiveness to the needs of sophisticated clients. This gives confidence to families that the jurisdiction is forward‑looking, not stagnant.

2. Tax‑Efficiency and Wealth Preservation

For UHNWIs and family offices, one of the practical imperatives of company formation in DIFC is wealth preservation, reducing drag from taxation, optimizing returns, and preserving the capital base for future generations. DIFC offers an attractive proposition:

- There are no personal income tax and no capital gains tax in the UAE for most categories of resident individuals subject to local conditions.

- DIFC’s corporate tax regime (for relevant entities) and other incentives make it a competitive base for holding companies, investment companies and single‑family offices.

- For families forming companies in DIFC (holding structures, investment vehicles, family‑office platforms), the tax burden is materially lower than many competing jurisdictions.

- Given that the Middle East is projected to see large transfers of generational wealth (for example, a 1 trillion USD transfer in the MEASA region by 2030), the ability to hold, transfer and manage assets cost‑effectively makes a DIFC‑company formation highly attractive.

3. Global Connectivity: East‑West Bridge

Another core proposition of company formation in DIFC is its strategic geographic positioning and global connectivity – the kind of connectivity that matters for families whose wealth footprint is international (Asia, Europe, Africa, North America).

- Location and time‑zone advantage

Dubai sits at a time‑zone intersection between Asia, Europe and Africa. For a business handling investment across regions, being able to communicate, transact and coordinate in a convenient time‑window is a practical advantage.

- Access and infrastructure

Dubai has excellent air connectivity, world‑class infrastructure, quality international schooling and lifestyle amenities that matter to families relocating talent, executives or family members. For a UHNWI thinking about forming a company in DIFC, location relates to lifestyle, talent, and access.

- Region‑wide investment frontier

DIFC sits in the Middle East, Africa and South Asia (MEASA) region, which is one of the fastest‑growing wealth corridors. According to reports, Dubai was ranked number one in the MEASA region for HNWIs and is among the top 22 cities globally in terms of wealth‑rich population centres. For a company formation in DIFC, this gives access to growth markets, talent and regional investment flows.

4. Deep Private‑Wealth and Family‑Office Ecosystem

What sets leading jurisdictions apart is not just the regulation or tax environment, but the ecosystem that supports wealth – the advisers, networks, service providers and structures that facilitate family offices. DIFC is leading in that dimension.

- Family Wealth Centre and tailored services

The DIFC Family Wealth Centre (DFWC) offers dedicated services for families and UHNWIs: advice on governance, succession, family office set‑up, dispute resolution, education and networking. That means when you form a company formation in DIFC, you are integrating into a broader platform built for your family‑office journey, rather than being an after‑thought.

- Scale of wealth‑management firms and foundations

DIFC is home to a large cluster of global wealth and asset management firms, hedge funds, private equity and venture capital firms. For example, as of mid‑2025, DIFC has over 440 wealth & asset managers, 85 hedge funds, and more than 1,000 family‑related businesses. This critical mass means that families forming companies in DIFC benefit from a rich supply‑chain of services: advisory, investment, structuring, governance and talent.

- Record surge in foundations & holding‑structures

In the UAE, and particularly DIFC, there has been a record surge in foundations (333 in 2023, projected 450+ in 2024) and holding companies. Moreover, the “prescribed company” or “SPV” regime in DIFC has seen surges in interest among single‑family offices and holding companies.

Why does this ecosystem matter for company formation?

When a family decides on company formation in DIFC, access to this ecosystem means:

- They can tap into specialist advisors experienced in high‑net‑worth structures, family‑office governance and cross‑border holding companies.

- They gain proximity to and collaboration with asset‑managers, investment firms, legal and tax specialists who serve UHNWIs and family offices.

- They plug into peer networks of other families, giving opportunities for co‑investment, knowledge‑sharing and governance benchmarking.

Why does DIFC company formation stand out for 2026?

- SPVs and Holding Company Growth: DIFC has seen significant interest in SPVs as part of its growth in family‑business and single‑family‑office activity. This momentum means forming a company in DIFC is part of a meaningful trend, not a niche experiment.

- Foundation + Company Synergy: Many families combine the use of DIFC foundations with holding companies to manage family assets, succession planning, and investment activity. The record surge in foundations underscores this dynamic. The company formation in DIFC therefore becomes part of a broader wealth architecture.

- Multigenerational Continuity & Succession: The ability to form a company in DIFC that is aligned with family governance, estate transfer and regulatory frameworks (via the Family Wealth Centre) makes it a strategic vehicle for 2026. Essentially, families are not just forming entities to ‘hold assets’ but to transmit and govern assets across generations.

- Access to Private Markets & Alternative Investments: Company formation in DIFC also gives access to private‐market deal flow (venture capital, private equity, hedge funds). DIFC’s ecosystem of asset managers, funds and advisers (over 440 firms, 85 hedge funds) gives families that vehicle. By forming a company in DIFC, the family office taps into a locale where investment flows and service providers are concentrated.

- Global Structuring & Cross‑Border Compatibility: Company formation in DIFC means aligning with global norms (common law), reputationally strong jurisdiction, and enabling global investment, talent mobility and inter‑family‑office operations. For families with assets in India, UK, Europe or Asia who want a wealth‑holding base, DIFC is increasingly seen as the default.

- Operational Services & Talent Availability: With company formation in DIFC, benefit from a ready‑pool of specialized professionals (legal, accounting, wealth advisers, governance specialists) who already cater to UHNWIs and family offices. This means better operationalization, lower risk of ‘ad hoc’ setup and better “go live” timescales.

Practical Guide to Company Formation in DIFC for UHNWIs & Family Offices

For families considering this move, here are practical steps and considerations:

1. Define the purpose of the company

- Is it a holding company for international assets?

- Is it an investment company focusing on private equity/venture?

- Is it a family office vehicle (single‑family office) to manage family wealth, governance, and investment?

- Is it part of a wider structure involving a foundation, trust, or multi‑jurisdictional vehicle?

2. Choose the appropriate legal form and licence

- In DIFC you may have various options: private company, SPV, investment company, etc.

- Ensure that the structure aligns with the activities (asset holding vs active management vs family office services).

- Consider whether the vehicle will actively manage assets or be a passive holding entity – this affects licensing, regulation and compliance.

3. Incorporation and registration

- Register with the DIFC Authority, select the company name, prepare constitutional documents, appoint directors/shareholders, and provide beneficial‑ownership information.

- Align with service‑provider requirements (audit, compliance, and governance).

- Consider opening bank accounts, ensuring suitable governance oversight and aligning with any residence/visas for key personnel.

4. Governance, board and succession planning

- For long‑term success, ensure the company has proper governance structures: board composition, family charter, succession policy, share‑holding structure, exit provisions.

- The DIFC Family Wealth Centre can assist families with accreditation, education, and governance tools.

5. Tax, regulatory and cross‑border alignment

- Although UAE offers tax advantages, families must still align with their home‑jurisdiction tax obligations (e.g., India, UK, EU).

- Consider residence status, anti‑money‑laundering obligations, beneficial‑ownership transparency, FATCA/CRS compliance.

- Ensure the DIFC company fits into the wider global structure (trusts, foundations, holding companies) if applicable.

6. Investment and operationalization

- Once established, the company must be operationally ready: accounting, audit, compliance, investment processes, reporting.

- If used for alternative investments (VC, PE, hedge funds), ensure the team and service‑provider ecosystem is in place.

- Consider domicile of investments, currency risk, asset‑allocation strategy, family‑charter alignment.

7. Ongoing governance and review

- Periodic review of structure is important: Is the company still fit for purpose? Has the family’s objective changed (e.g., shift from growth to preservation)?

- Leverage the DIFC Family Wealth Centre’s resources for educational programmes, networking and best‑practice family‑office governance.

How MS Can Help in Company Formation in DIFC?

At MS, we guide UHNWIs and family offices through every stage of their wealth structuring and corporate setup in DIFC. Our services cover company formation in DIFC, holding and investment structures, governance frameworks, and succession planning. We ensure that your family office or corporate entity is fully compliant with DIFC regulations while optimizing tax efficiency, privacy, and operational effectiveness.

Our team of experts provides:

- End-to-end company formation support – from entity selection and incorporation to licensing and registration.

- Governance and succession advisory – designing structures that ensure smooth intergenerational wealth transfer.

- Access to the DIFC ecosystem – connecting you with trusted financial, legal, and investment partners.

- Customized solutions for family offices and UHNWIs – tailored strategies for asset management, private investments, and alternative assets.

With MS as your partner, forming and managing company formation in DIFC becomes a strategic move to secure, grow, and future-proof your family wealth in a global context.