The Essentials

Expanding internationally is complex for UAE and regional companies due to regulatory, financial, operational, and credibility challenges. Setting up a company in DIFC provides a globally recognized legal framework, access to international capital, operational flexibility, and networking opportunities. By leveraging DIFC’s ecosystem through robust compliance, strategic structuring, and international partnerships, companies can efficiently and confidently pursue cross-border expansion, with a strong foundation for growth in 2026 and beyond.

In an increasingly globalized economy, UAE and regional companies are seeking growth beyond their domestic markets. While international expansion offers the promise of higher revenues, diversified operations, and enhanced brand visibility, it also comes with a host of challenges like regulatory complexity, financing hurdles, legal uncertainty, and operational risks.

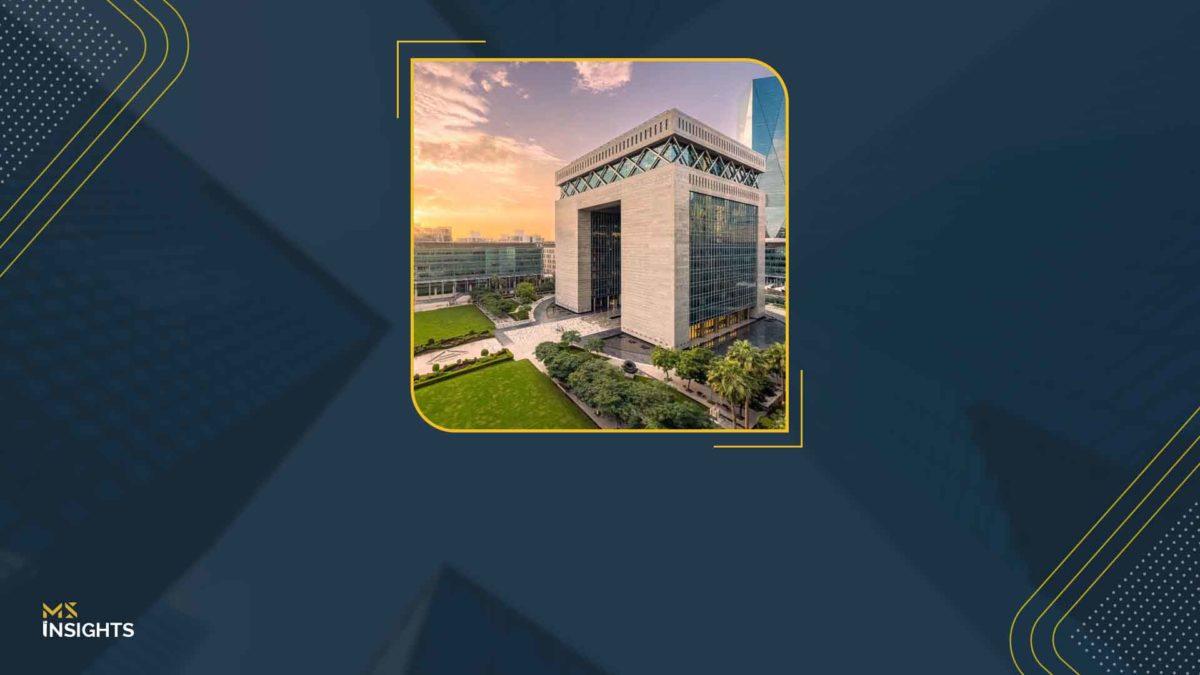

Setting up a company in DIFC has emerged as a strategic solution to these challenges, providing a world-class ecosystem that enables companies to expand confidently across borders. With 2026 on the horizon, DIFC continues to evolve its offerings to support the next wave of regional businesses aiming for global impact.

Let’s explore the common pain points companies face in cross-border expansion and how setting up a company in DIFC is uniquely positioned to address them today and into 2026.

Setting Up a Company in DIFC: Overcoming the Key Challenges for UAE Businesses

Challenge 1: Tackling Regulatory Complexity

Expanding into international markets often means dealing with unfamiliar legal systems, compliance standards, and regulatory frameworks. For many UAE and regional companies, this is a primary barrier to growth.

Solution: DIFC’s Robust Legal and Regulatory Ecosystem

- Independent Legal System: DIFC operates under English common law, providing clarity and predictability in contracts, dispute resolution, and governance.

- DFSA Oversight: The Dubai Financial Services Authority regulates financial activities to global standards, ensuring regulatory compliance aligns with international best practices.

- Simplified Licensing & Cross-Border Transactions: DIFC allows companies to obtain licenses to operate internationally while maintaining alignment with local UAE laws.

Setting up a company in DIFC is expected to become even more efficient as DIFC enhances digital regulatory solutions, making compliance seamless for companies with international operations. This includes AI-powered monitoring and streamlined virtual licensing processes to reduce administrative burdens.

Challenge 2: Securing Capital for Expansion

Cross-border growth often requires significant funding for acquisitions, new offices, technology, or talent. Companies outside global financial hubs often struggle to access international capital.

Solution: DIFC’s Financial Infrastructure and Funding Access

- Global Banking Ecosystem: DIFC hosts international banks, asset managers, and private equity firms, offering companies direct access to cross-border financing solutions.

- Capital Markets Access: Companies can raise funds via DIFC-regulated platforms or through NASDAQ Dubai listings, connecting with global investors.

- Structured Finance & SPVs: Special Purpose Vehicles allow companies to structure cross-border deals efficiently, offering legal security and tax optimization.

DIFC is strengthening its fintech and digital asset ecosystem, enabling companies to leverage innovative funding mechanisms, including tokenized assets, cross-border payment solutions, and green finance instruments, to accelerate international expansion.

Challenge 3: Building Credibility and Trust with International Partners

Entering new markets requires credibility. Foreign investors and partners often scrutinize operational transparency, corporate governance, and legal compliance.

Solution: DIFC as a Trusted Business Hub

- Internationally Recognized Standards: DIFC companies operate under globally accepted governance and compliance norms, building trust with international stakeholders.

- Networking and Partnerships: DIFC’s ecosystem of multinational corporations, law firms, and advisory services allows companies to connect with global partners for joint ventures, M&A, or trade relationships.

- Reputation Benefits: Being headquartered in DIFC signals financial integrity and regulatory compliance to potential partners.

Setting up a company in DIFC is increasingly positioning regional businesses to access emerging markets in Africa, Asia, and Europe. Its reputation as a secure, internationally compliant hub will be a key factor in facilitating partnerships and joint ventures globally.

Challenge 4: Managing Tax and Operational Efficiency

Companies expanding internationally face the challenge of tax complexity, profit repatriation, and operational efficiency. Unfavorable tax structures or operational bottlenecks can undermine expansion plans.

Solution: DIFC’s Tax and Operational Advantages

- 0% Corporate Tax (Free Zone): DIFC offers corporate tax exemption for qualifying income, reducing the cost of international operations.

- Profit Repatriation Freedom: Companies can move capital and profits freely, making international deals and investments smoother.

- Streamlined Operations: DIFC’s digital infrastructure, licensing solutions, and professional services ecosystem allow companies to operate efficiently across borders.

DIFC is expected to enhance digital operational tools, including integrated platforms for cross-border reporting, tax compliance, and corporate governance, making operational efficiency even more attainable for expanding companies.

Challenge 5: Accessing Talent and Expertise

Expanding internationally requires specialized talent, especially in compliance, finance, legal, and technology. Regional companies often struggle to recruit and retain talent with global expertise.

Solution: DIFC’s Talent Ecosystem

- Professional Services Network: DIFC is home to top-tier advisory, law, and consulting firms that provide guidance on cross-border operations.

- Executive Recruitment: Companies can tap into DIFC’s ecosystem for skilled professionals experienced in international markets.

- Knowledge Sharing & Forums: DIFC hosts events, workshops, and forums connecting companies to global expertise.

As cross-border operations become more tech-driven, DIFC is focusing on attracting digital talent, fintech specialists, and ESG experts, ensuring regional companies have access to skills critical for future global expansion.

Setting Up a Company in DIFC – Practical Case Studies

While specific client names are often confidential, several generalized examples illustrate DIFC’s role in facilitating cross-border expansion:

- Fintech Startup: Leveraged DIFC’s regulatory framework to secure licenses, access international investors, and expand operations into Europe and Asia.

- Asset Management Firm: Established SPVs within DIFC for cross-border investment management, benefiting from transparent legal structures and global banking access.

- Technology Company: Used DIFC’s networking ecosystem to partner with global accelerators and scale products across GCC and African markets.

Setting Up a Company in DIFC in 2026: Strategic Recommendations

As we approach 2026, regional companies can leverage DIFC more strategically for cross-border expansion:

- Digital Compliance Integration: Use DIFC’s digital regulatory solutions to simplify licensing and reporting.

- Leverage ESG and Sustainability Trends: Align operations with global ESG standards to attract international investors.

- Explore Fintech and Digital Asset Opportunities: Utilize DIFC’s emerging fintech ecosystem to innovate funding and operational models.

- Strengthen International Partnerships: Engage DIFC’s networking platforms to identify joint ventures and collaborations in high-growth markets.

- Utilize SPVs and Structured Finance: Strategically structure international deals to optimize tax, legal protection, and operational efficiency.

How MS Can Help with Setting Up a Company in DIFC for Cross-Border Expansion?

Setting up a company in DIFC is the critical first step for UAE and regional businesses aiming to expand internationally. The process involves going through licensing requirements, regulatory compliance, and corporate governance rules—all of which can be complex without expert guidance. MS offers end-to-end support to ensure a smooth, compliant, and efficient setup tailored for cross-border operations.

1. Entity Selection and Structuring

- MS helps businesses choose the most suitable entity type in DIFC, whether it’s a Limited Liability Company (LLC), Free Zone Company, or SPV based on your growth strategy, operational needs, and international expansion plans.

- We advise on structures optimized for cross-border trade, capital raising, and tax efficiency.

- Our team ensures alignment with DIFC rules and international business standards.

2. Licensing and Regulatory Approvals

Setting up in DIFC requires multiple approvals from the Dubai Financial Services Authority (DFSA) and DIFC Registry. MS guides companies through:

- Obtaining the correct license for your business activity.

- Meeting DFSA requirements for financial services, professional services, or general commercial operations.

- Completing all registration and compliance formalities efficiently.

- This ensures your company is legally recognized, fully compliant, and ready to operate both locally and internationally.

3. Compliance and Corporate Governance Setup

MS assists in implementing robust corporate governance frameworks that meet DIFC standards:

- Drafting constitutional documents and shareholder agreements.

- Establishing board structures and compliance policies.

- Advising on ongoing statutory filings, beneficial ownership records, and KYC/AML compliance.

- Strong governance not only ensures regulatory compliance but also builds credibility with international investors and partners.

4. Operational Readiness and Support

MS helps you get your DIFC company operational quickly and efficiently:

- Setting up banking and payment solutions.

- Connecting with local service providers, offices, and professional networks.

- Advising on talent hiring, payroll, and HR structures aligned with DIFC requirements.

- This allows companies to focus on strategic growth rather than administrative challenges.

5. Strategic Advisory for Cross-Border Expansion

Once you are done with setting up a company in DIFC, MS continues to support your international ambitions:

- Identifying cross-border growth opportunities.

- Structuring SPVs or subsidiaries for global operations.

- Providing guidance on taxation, compliance, and operational efficiency for foreign markets.