Thinking of setting up an SPV in ADGM?

If you’re looking to structure investments, isolate risk, or hold assets efficiently, ADGM offers a legally robust, tax-efficient, and investor-friendly platform. With English common law certainty, flexible ownership and share structures, fully digital incorporation, and minimal operational requirements, ADGM SPVs are ideal for corporates, family offices, and financial institutions.

As global investments become more sophisticated, Special Purpose Vehicles (SPVs) have moved from being optional structuring tools to core components of modern structuring architecture. Whether the objective is asset holding, project financing, joint ventures, securitization, or succession planning, the jurisdiction in which an SPV is established directly affects risk exposure, tax efficiency, investor confidence, and long-term flexibility.

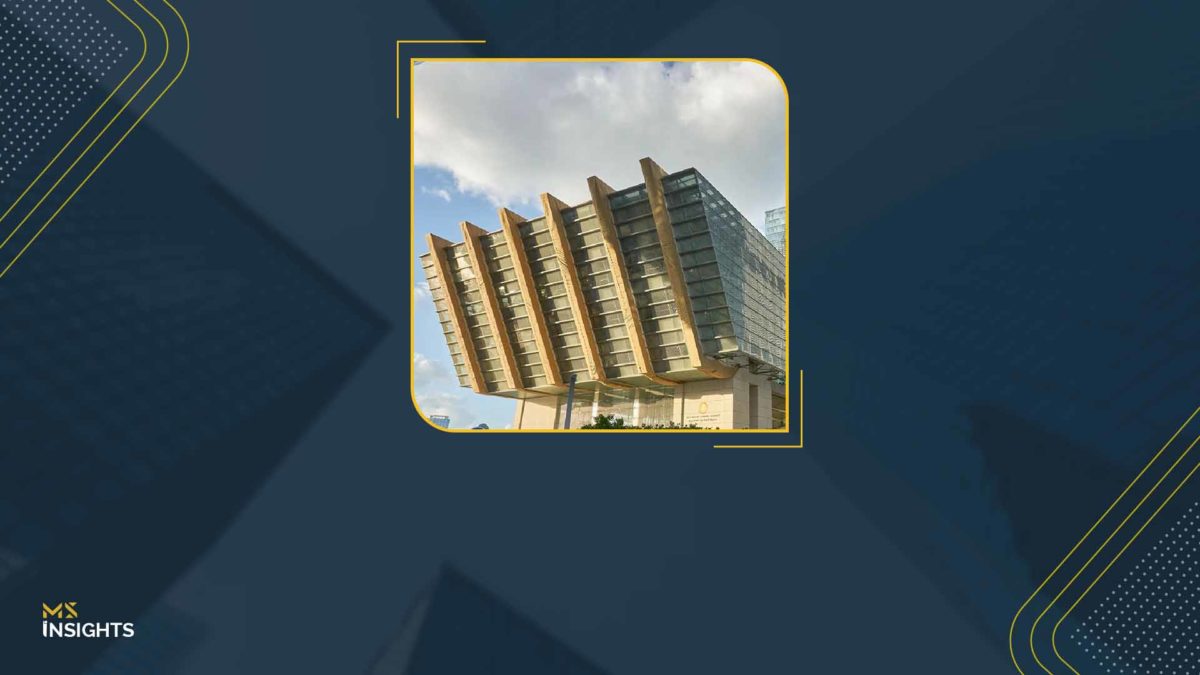

Abu Dhabi Global Market (ADGM) has positioned itself as one of the most advanced and credible SPV jurisdictions globally combining common law certainty, regulatory credibility, and a business-friendly environment within the UAE.

Let’s explore why SPV structuring in ADGM stands out and why it is increasingly the jurisdiction of choice for investors, corporates, family offices, and financial institutions.

Understanding the Strategic Role of an SPV Structuring in ADGM

An SPV is a legally independent entity created for a specific, limited purpose – often to:

- Hold assets or shares

- Ring-fence liabilities

- Facilitate financing or securitization

- Enable co-investments or joint ventures

- Support estate, wealth, or succession planning

The effectiveness of setting up a SPV in ADGM depends not only on its structure, but also on the legal and regulatory ecosystem in which it operates. This is where ADGM delivers a significant advantage.

Why ADGM Is the Ideal Jurisdiction for SPV Structuring?

1. English Common Law Framework: Legal Certainty at the Core

ADGM is unique in the region for directly applying English common law, rather than adapting or referencing it. This provides:

- Predictability in legal interpretation

- Familiarity for international investors, lenders, and counsel

- Confidence in enforceability of contracts and shareholder arrangements

ADGM also operates its own independent courts, separate from the UAE civil court system, ensuring transparent and internationally aligned dispute resolution.

SPVs are often used in complex, high-value transactions involving multiple jurisdictions. Legal certainty reduces execution risk, improves bankability, and increases investor confidence.

2. Strong Regulatory Credibility Without Overregulation

ADGM’s regulatory framework is designed to balance robust governance with commercial flexibility. While SPV formation in ADGM is subject to appropriate oversight, they are not burdened with the same regulatory obligations as operating companies or licensed financial institutions.

This approach:

- Enhances credibility with counterparties and regulators

- Ensures compliance with international standards (AML, governance, transparency)

- Avoids unnecessary operational friction

For SPVs holding significant assets or participating in cross-border structures, regulatory credibility is often as important as tax efficiency.

3. Tax Efficiency and Global Structuring Advantages

ADGM SPVs benefit from the UAE’s broader tax environment, including:

- 0% corporate tax on qualifying income

- No withholding tax on dividends, interest, or royalties

- No capital gains tax

- Eligibility to apply for UAE tax residency, subject to substance and structuring

This enables access to the UAE’s extensive double tax treaty network, making ADGM SPV setup highly effective for international holding and investment structures.

For investors and groups with cross-border assets, tax leakage can significantly impact returns. ADGM allows for clean, efficient structuring while remaining compliant with global standards.

4. Efficient, Fully Digital Incorporation Process

ADGM offers a streamlined, digital-first incorporation process, including:

- Online application and document submission

- Fast incorporation timelines

- Centralized portal for filings and renewals

This significantly reduces administrative delays and uncertainty, particularly when SPVs are required quickly as part of a transaction timeline.

In deals, project finance, or capital raising, timing is critical. Delays in entity formation can stall or even derail deals.

5. No Minimum Capital & Flexible Share Structures

ADGM SPVs benefit from:

- No minimum share capital requirement

- Ability to issue multiple classes of shares

- Customizable rights relating to voting, dividends, and exits

This flexibility to set up an SPV allows sponsors to align governance and economics precisely with deal requirements.

Whether structuring private equity investments, co-investments, or family office vehicles, flexibility in capital design is essential for long-term alignment.

6. 100% Foreign Ownership with No Local Sponsor

ADGM allows full foreign ownership of SPVs with no requirement for local shareholders or sponsors. This removes complexity, preserves control, and avoids nominee risks, particularly important for international investors and family offices seeking clean ownership structures.

7. Effective Ring-Fencing of Assets and Liabilities

One of the primary reasons for using an SPV formation in ADGM is risk isolation. ADGM SPVs are legally separate entities, ensuring:

- Liabilities are confined to the SPV

- Parent entities and other group companies are protected

- Clear separation for financing and security purposes

This is critical in project finance, real estate, securitization, and joint ventures, where exposure must be tightly controlled.

8. No Physical Office Requirement

ADGM does not require SPVs to lease or maintain physical office space. A registered address provided by a licensed service provider is sufficient.

This significantly reduces ongoing costs and administrative complexity, particularly for holding or investment-only vehicles.

SPV Structuring in ADGM: Wide Range of Practical Use Cases

ADGM SPVs are commonly used for:

- Holding shares in operating companies

- Real estate and infrastructure investments

- Securitization of receivables or assets

- Joint ventures and consortium structures

- Family wealth, succession, and estate planning

How MS Can Help with SPV Structuring in ADGM?

MS supports clients through the setup of SPVs in ADGM, ensuring the structure is aligned with its intended purpose from the outset. Our support includes advising on the appropriate SPV structure, managing the incorporation process with ADGM, and assisting with core documentation and compliance requirements.

With hands-on experience across ADGM and DIFC structures, MS helps investors, corporates, and family offices set up efficient, compliant, and future-ready SPVs with minimal friction.