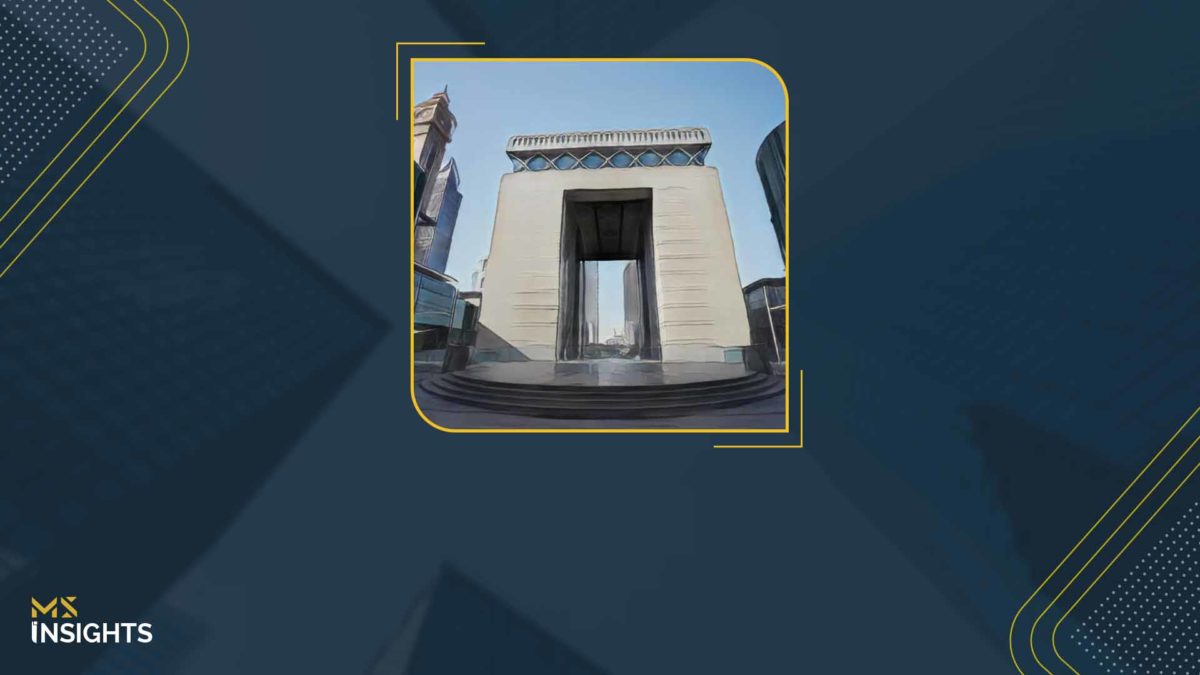

Looking for a cost-effective yet efficient way to structure your business in DIFC? A DIFC Prescribed Company might be exactly what you need. Designed for specific business purposes, it offers a streamlined setup, lower costs, and access to a globally recognized financial hub. But is your business eligible? And how can this structure work to your advantage?

We’ll walk you through the key qualifying purposes of a DIFC Prescribed Company setup —helping you determine if it’s the right move for your business.

Let’s dive in!

DIFC Prescribed Company Setup: Versatile Structures for Diverse Business Needs

1. Aviation Structure – Taking Businesses to New Heights

If your business involves owning, financing, leasing, or operating aircraft, a DIFC Prescribed Company can be the perfect vehicle. This structure is particularly useful for aircraft leasing companies, financial institutions, and aviation operators looking for a secure jurisdiction with well-defined regulations.

Who benefits? – Aviation firms, asset financiers, and aircraft lessors.

2. Crowdfunding Structure – A Secure Hub for Investments

For companies operating in the crowdfunding space, the DIFC Prescribed Company setup allows them to hold assets raised through a DFSA-licensed crowdfunding platform. This ensures investor confidence, regulatory compliance, and efficient asset management within a financial hub that encourages innovation.

Who benefits? – Startups, fintech platforms, and investment firms engaged in crowdfunding.

3. Family Holding Structure – Protecting Wealth for Generations

A DIFC Prescribed Company setup is a smart choice for families looking to consolidate and manage their assets. Whether through a family office, holding company, or proprietary investment company, this structure simplifies asset management while ensuring long-term succession planning and wealth protection.

Who benefits? – High-net-worth families, private investors, and family offices.

4. Structured Financing – Managing Complex Financial Transactions

For businesses involved in leveraging assets, risk management, or complex financing, a DIFC Prescribed Company setup offers a structured framework. This is particularly useful for securitized debt instruments, derivative transactions, hybrid securities, and large-scale lending arrangements.

Who benefits? – Financial institutions, investment banks, and hedge funds.

5. DIFC Holding Structure – Centralizing Business Operations

Holding shares in multiple DIFC entities? A DIFC Prescribed Company setup streamlines corporate governance by allowing businesses to hold and manage shares within the DIFC ecosystem. This simplifies operations and provides a structured approach to managing business interests.

Who benefits? – Businesses with multiple subsidiaries, corporate investors, and holding companies.

6. Innovation Holding Structure – Supporting the Future of Technology

A DIFC Prescribed Company setup can hold shares in global entities focused on technology, innovation, and R&D. Whether in fintech, artificial intelligence, blockchain, or renewable energy, this structure provides a strong foundation for growth and investment.

Who benefits? – Tech startups, venture capitalists, and businesses developing cutting-edge solutions.

Why DIFC Prescribed Company Setup is the Smart Choice for Your Business?

A DIFC Prescribed Company combines cost efficiency with strategic flexibility, offering a lower setup and operational cost alternative to full DIFC entities without compromising on regulatory integrity. It operates within a globally recognized legal framework, ensuring compliance while providing businesses with the agility to structure assets and operations effectively. Additionally, it unlocks access to DIFC’s dynamic financial ecosystem, connecting companies to a robust network of investors, financial institutions, and global market opportunities.

Why MS? Your DIFC Prescribed Company Setup Partner

When it comes to establishing a DIFC Prescribed Company, precision matters—and that’s where MS excels. Our expertise in DIFC structuring, compliance, and corporate services ensures a seamless setup, cost-effective solutions, and full regulatory alignment. Whether you’re consolidating assets, managing structured finance, or exploring innovative business models, we provide tailored guidance to help you maximize the benefits of a DIFC Prescribed Company. With MS, you get efficiency, expertise, and a partner dedicated to your success.